EMEA Office Fit Out Cost Guide 2024

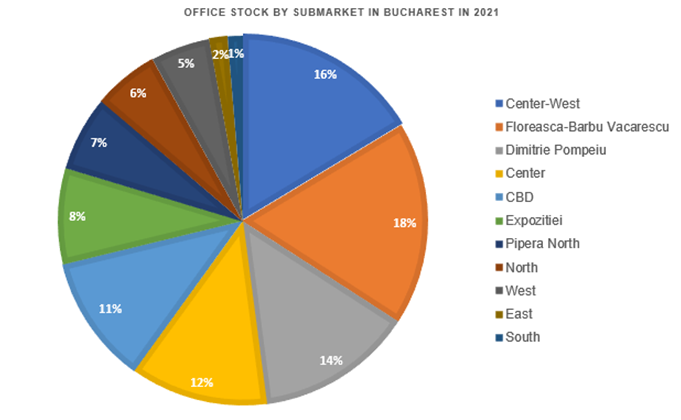

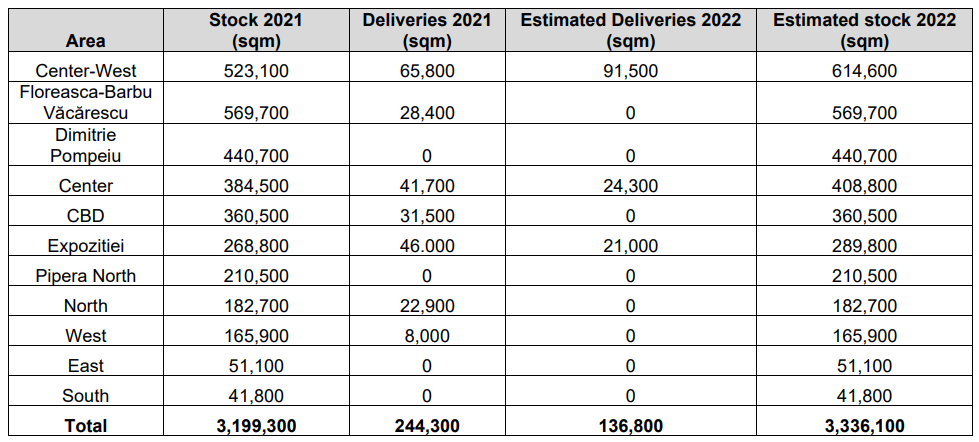

Bucharest, March 2022: The office stock in the Center-West area of Bucharest, near Politehnica University, will surpass the existing stock from Floreasca-Barbu Văcarescu (which has been the main office hub in Bucharest for eight years) in 2022, , according to data from the Cushman & Wakefield Echinox real estate consultancy company.

The modern office stock in the Center -West sub-market, has reached 523,000 square meters at the end of last year, and it is expected to increase to 614,000 square meters by the end of 2022. As a result, this sub-market will have a share of 18% of the total office stock in Bucharest.

In regards to Floreasca-Barbu Văcărescu, the existing projects accounted for 569,700 square meters at the end of 2021, with no new deliveries being planned for 2022. Therefore the stock in this area will be lower compared with Center-West’s at the end of this year, representing 16% of the total office stock in the Capital city.

In regards to Floreasca-Barbu Văcărescu, the existing projects accounted for 569,700 square meters at the end of 2021, with no new deliveries being planned for 2022. Therefore the stock in this area will be lower compared with Center-West’s at the end of this year, representing 16% of the total office stock in the Capital city.

According to the Bucharest Office Market report, only 3 out of the Bucharest’s 11 office sub-markets will benefit from new projects this year, namely Center-West, Center and Expoziției, the new supply amounting to 136,800 square meters.

Eduard Turcoman, Director Office Agency Cushman & Wakefield Echinox: “The evolution is mainly influenced by the lack of land plots suitable for office projects in the Floreasca-Barbu Văcărescu area, an area responsible for more than a third of the new supply in Bucharest between 2013 and 2021. Demand remains strong for this sub-market, taking into account the volume of transactions registered during the last few years and also the vacancy rate which is below the market average. For the coming period, there are strong premises for a reduction of the average vacancy rate in Bucharest, given the difficulties related to authorization process, in the context of the blocked local PUZ, which will generate a reduction of the new office projects supply, in a market where the annual demand still remains at around 300,000 square meters.”

Eduard Turcoman, Director Office Agency Cushman & Wakefield Echinox: “The evolution is mainly influenced by the lack of land plots suitable for office projects in the Floreasca-Barbu Văcărescu area, an area responsible for more than a third of the new supply in Bucharest between 2013 and 2021. Demand remains strong for this sub-market, taking into account the volume of transactions registered during the last few years and also the vacancy rate which is below the market average. For the coming period, there are strong premises for a reduction of the average vacancy rate in Bucharest, given the difficulties related to authorization process, in the context of the blocked local PUZ, which will generate a reduction of the new office projects supply, in a market where the annual demand still remains at around 300,000 square meters.”

In regards to the vacancy rate, there is a wide gap pertaining to the 11 analyzed sub-markets from the Cushman & Wakefield Echinox report, with the highest levels being recorded in Pipera North and East, and the lowest in the West, Dimitrie Pompeiu and Center sub-markets.

Vacancy rates above the market average are also recorded in North and South. We notice a higher vacancy rate in buildings which have been completed more than 10 years ago and also in properties without direct access to the metro. Considering that the new projects bring the highest innovative technologies, materials and building solutions to the market, they are constantly preferred by tenants over older buildings, thus generating large unoccupied areas.

Cushman & Wakefield Echinox is one of the largest real estate consulting companies in the local market, operating on all the real estate market segments. The company’s office department is active in Bucharest, but also in the largest cities in the country, such as Cluj-Napoca, Timisoara, Iasi or Brasov.

Cushman & Wakefield Echinox is a top real estate consulting company on the local market and the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, with a team of over 80 professionals and collaborators offering a full range of services to investors, developers, landlords and tenants. For more information, visit www.cwechinox.com

Cushman & Wakefield, one of the global leaders in commercial real estate services, with 50,000 employees in over 60 countries and $ 9.4 billion in revenue, provides asset and investment management consulting services, capital markets, leasing, properties administration, tenant representation, project management, design and evaluation services. For more information, visit www.cwechinox.com