European Outlook 2026

Bucharest, January 2024: Macroeconomic uncertainty, consumption contraction, interest rates and also inflation are the main factors which may impact the Romanian real estate market, according to the real estate investors and developers who responded to the second edition of the Cushman & Wakefield Echinox “Real Estate Investors Sentiment Barometer”.

However, despite all the above-mentioned issues, investors remain positive and their expansion plans in Romania are largely intact.

However, despite all the above-mentioned issues, investors remain positive and their expansion plans in Romania are largely intact.

Cushman & Wakefield Echinox surveyed the top management of local, regional and global investors and developers with a combined real estate portfolio in Romania valued at more than EUR 10 billion, having a share of approximately 50% of the local real estate market.

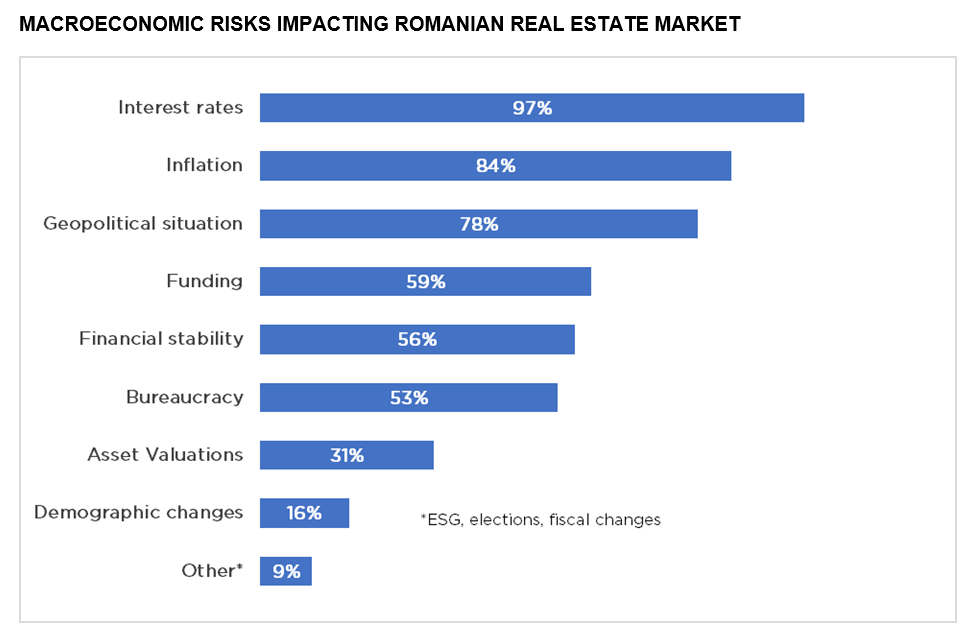

The main concern for real estate players pertains to the interest rates’ level, which was indicated almost unanimously (97% of respondents) as the most important macroeconomic risk which could impact the real estate market in Romania, a market which will also be influenced by inflation (84%) and by the geopolitical situation (78%) according to the respondents.

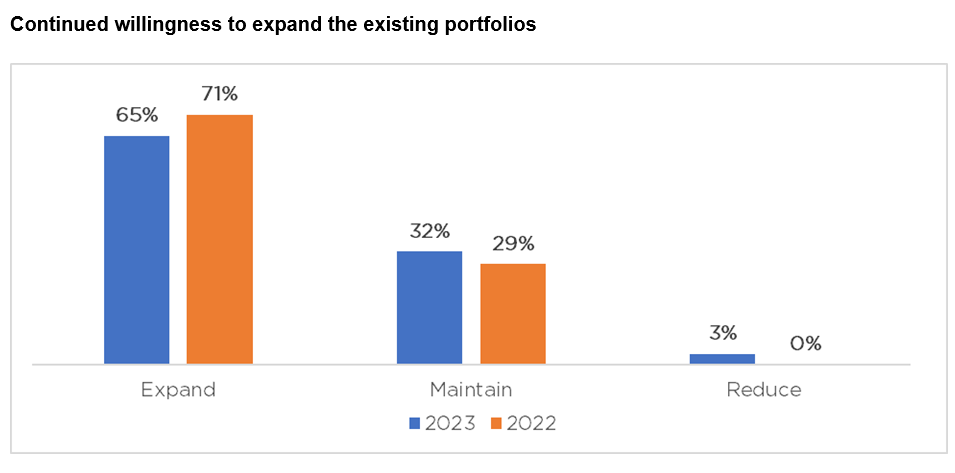

Despite the challenges faced by the market, most of the responding investors (65%) are looking to expand their portfolios, while 32% aim to maintain their current assets in the following three years and only 3% of respondents have indicated expectations of downsizing their activity.

Vlad Săftoiu, Head of Research Cushman & Wakefield Echinox: ”The second edition of the survey among real estate investors and developers in Romania has once again highlighted their confidence in the local market, a market which continued to perform in 2023 in terms of both supply and demand. 2023 saw new records, especially at demand level, in line with the respondents’ expectations in the survey conducted at the end of 2022. Financing costs and inflation remain the main concerns, but we believe that they will ease throughout 2024 and the pressure on the real estate sector will be less significant”.

Vlad Săftoiu, Head of Research Cushman & Wakefield Echinox: ”The second edition of the survey among real estate investors and developers in Romania has once again highlighted their confidence in the local market, a market which continued to perform in 2023 in terms of both supply and demand. 2023 saw new records, especially at demand level, in line with the respondents’ expectations in the survey conducted at the end of 2022. Financing costs and inflation remain the main concerns, but we believe that they will ease throughout 2024 and the pressure on the real estate sector will be less significant”.

Bucharest remains the preferred destination for future real estate investments, while the secondary markets (cities with a population >250,000) are also considered a place to be by many investors and developers.

Therefore, 66% vs 63% in 2022 of respondents indicate Bucharest as their main target for new investments, while only 24% are actively looking at tertiary locations (cities with less than 250,000 inhabitants). Almost 50% of investors consider secondary cities an attractive destination to invest.

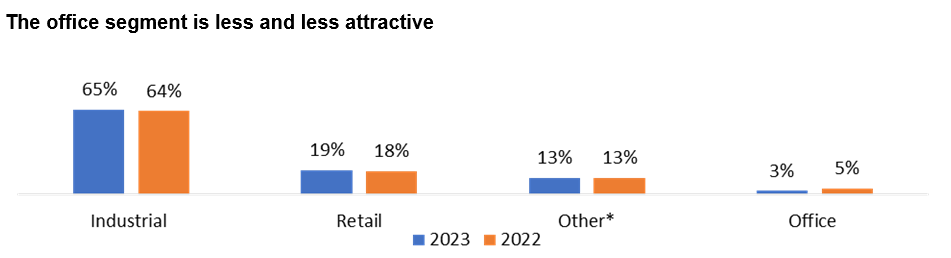

In terms of the market segment which will attract new investments in the following 12 months, offices are less and less attractive, with only 3% of respondents (compared with 5% in 2022) expecting more development activity in the office market. The low apetite for this particular segment can be explained by the bureaucratic issues in Bucharest and the uncertainty surrounding the permitting process pertaining to new projects. A special mention also goes to the Private Rented Sector (PRS) and data centers which are also forecasted to see more investments than the office sector from 2024 onwards.

A vast majority (75%) foresee more developments in the industrial segment, while 19% expect new investments in retail projects. Both segments saw an increasing investor interest in 2023.

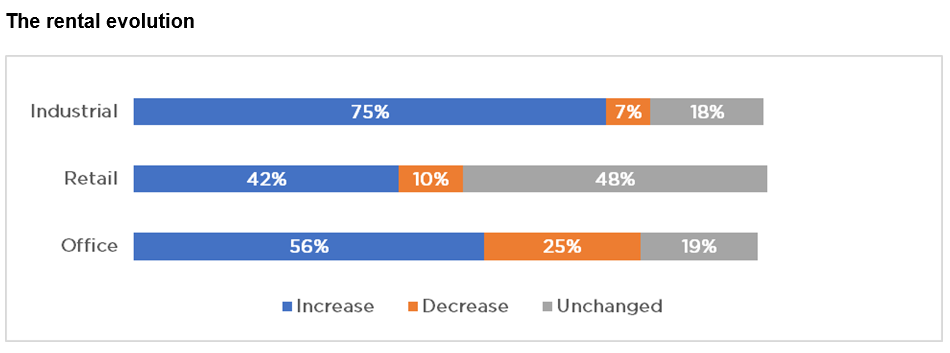

In terms of the rental evolution, most respondents (75% vs 55% in 2022) predict an upward movement for the office and industrial (58%) rents, while a stagnation was indicated for retail assets (49% of respondents).

Inflation (91%), financing costs (78%) and construction costs (66%) are the main factors which may influence the rental levels, while the level of competition on the market and the lack of new supply in the office sector in particular were also indicated by respondents.

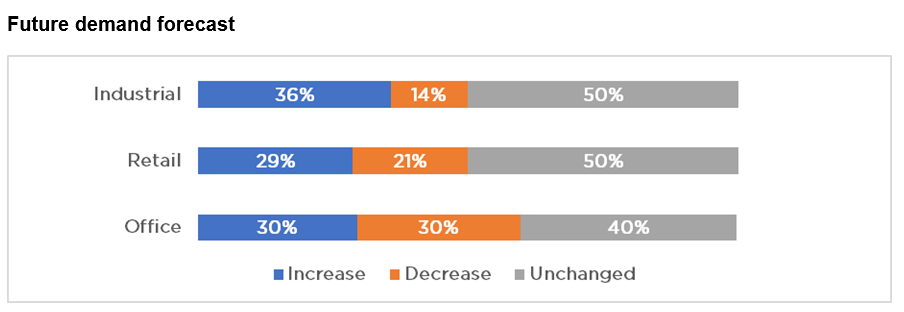

Moreover, most investors forecast a medium-term stability for all types of spaces when it comes to the future demand. The main factors which may impact (in a positive or negative way) the evolution of demand are macroeconomic uncertainty, consumption contraction, interest rates and geopolitical situation.

The 2023 edition of Real Estate Investors Sentiment Barometer also surveyed the real estate investors’ sustainability/ESG actions.

The results show that a majority of investors/developers have taken concrete steps in terms of implementing the Sustainability/ESG standards and also of developing and operating environmentally responsible buildings. Moreover, their plans include more actions, such as certifying their portfolios, having a documented ESG strategy, securing budgets to improve sustainability/ESG performance.

Investing in sustainability and ESG actions has become a key factor required to attract and retain tenants, as most respondents indicated tenant requests as their main motivation to invest in sustainable and eco-friendly buildings. Investors are also driven by their own values (56%), while 47% believe that investing in sustainability/ESG is a market differentiator.

Cushman & Wakefield Echinox is a leading real estate company on the local market and the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, with a team of over 80 professionals and collaborators offering a full range of services to investors, developers, owners and tenants.

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in approximately 400 offices and 60 countries. In 2022, the firm reported revenue of $10.1 billion across its core services of property, facilities and project management, leasing, capital markets, and valuation and other services. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity and Inclusion (DEI), Environmental, Social and Governance (ESG) and more. For additional information, visit www.cushmanwakefield.com.