European Outlook 2026

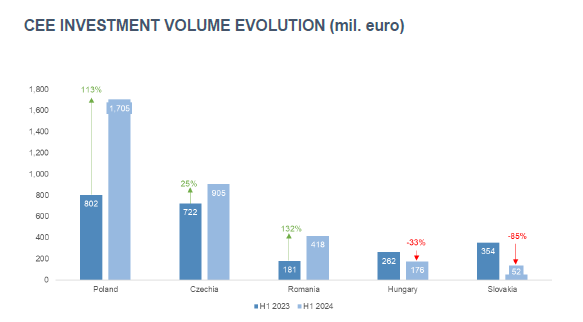

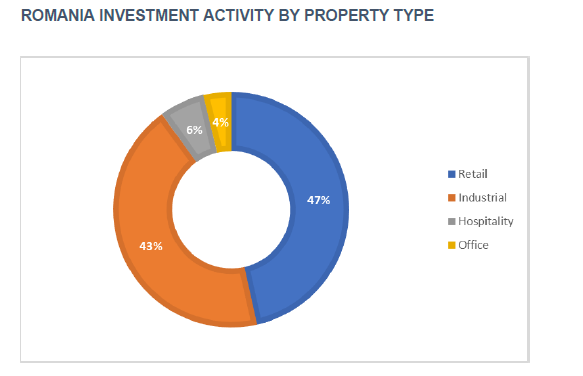

Bucharest, August 2024: Romania recorded a 131% y-o-y growth of the real estate transaction volume during H1 2024, reaching a level of €418 million, corresponding to the highest growth rate in the Central and Eastern Europe (CEE). This significant evolution places Romania 3rd in the region, following Poland and Czechia, surpassing Hungary and Slovakia. The retail and industrial segments were the main drivers on the local market, accounting for 90% of the total volume, while office transactions comprised just 4%, according to data from the Cushman & Wakefield Echinox real estate consultancy company.

The total transactional volume at regional level (Romania, Poland, Czechia, Hungary and Slovakia) reached €3.26 billion in H1 2024, a 40% growth compared with the same period of 2023. Poland experienced an increase of 113%, while the investment volume in the Czech market saw a 19% rise. On the other hand, Hungary witnessed a 33% decline of the volume invested in income-producing real estate assets, with Slovakia registering an even more pronounced contraction of 73%.

In Romania, 38 transactions were recorded throughout H1, compared with 17 in H1 2023, according to the Romania Investment Marketbeat report released by Cushman & Wakefield Echinox.

Moreover, H1 2024 has been the most active first semester since 2017, while the second half of the year is usually stronger in terms of transactions.

Cristi Moga, Head of Capital Markets at Cushman & Wakefield Echinox: “We have witnessed a rebound of the investors’ interest in the local real estate market in H1 2024, with an increased activity being observed especially from the existing players in the country. The forecast for the second half of this year remains positive, in a context characterized by more relaxed financing conditions and by stabilizing prices. Therefore, highly significant transactions are expected to be closed in the coming months, particularly on the retail and office segments, as the total 2024 transactional volume is due to be in the region of €1 billion, a normal yearly level for the local market over the past decade.”

Retail had the highest volume share (47%) in H1, followed by the Industrial (43%), Hospitality (6%) and Office (4%) segments.

The largest transaction closed in the analyzed period pertained to the CTP acquisition of 6 industrial & logistics parks from Globalworth (267,900 sq. m GLA) for €168 million, a transaction through which CTP further consolidated its dominant position in this market segment. Another major deal closed in H1 was related to the WDP purchase of Expo Market Doraly, a 100,000 sq.m retail and wholesale center near Bucharest for ~€90 million.

The prime yields have been very stable across all segments in H1, with only a 10 bp spike being recorded for industrial properties compared with the end of 2023. Therefore, the levels range between 7.25% for office and shopping center assets and 7.50% for industrial properties.