European Outlook 2026

Bucharest, August 2024: Retail projects totaling more than 87,000 sq. m were delivered throughout H1 2024, corresponding to a sharp increase when compared with the 30,000 sq. m new supply from the same period of 2023. This year’s evolution was mainly fueled by the second quarter completions, according to data from the Cushman & Wakefield Echinox real estate consultancy company.

Projects with a cumulative area of 78,100 sq. m were delivered in Q2 2024, an impressive growth compared with the previous quarter (9,300 sq. m) and also with Q2 2023 (17,000 sq. m).

The new supply was dominated by the shopping center format, following the completion of Arges Mall, a 51,400 sq. m shopping center developed by Prime Kapital – MAS Real Estate in Pitesti and the 2nd phase of Fashion House Pallady in Bucharest (5,700 sq. m) by Liebrecht & WooD.

Moreover, two retail parks were also delivered, namely Aurora Retail Park in Giurgiu and OK Shopping Center in Bistrita, totaling 21,000 sq. m GLA.

The modern retail stock in Romania was of 4.54 million sq. m at the end of H1, out of which 55% consisted of shopping centers, while retail parks and commercial galleries accounted for the other 45%.

The pipeline for H2 2024 is also robust, as projects cumulating around 155,000 sq. m are due to be delivered by the end of the year.

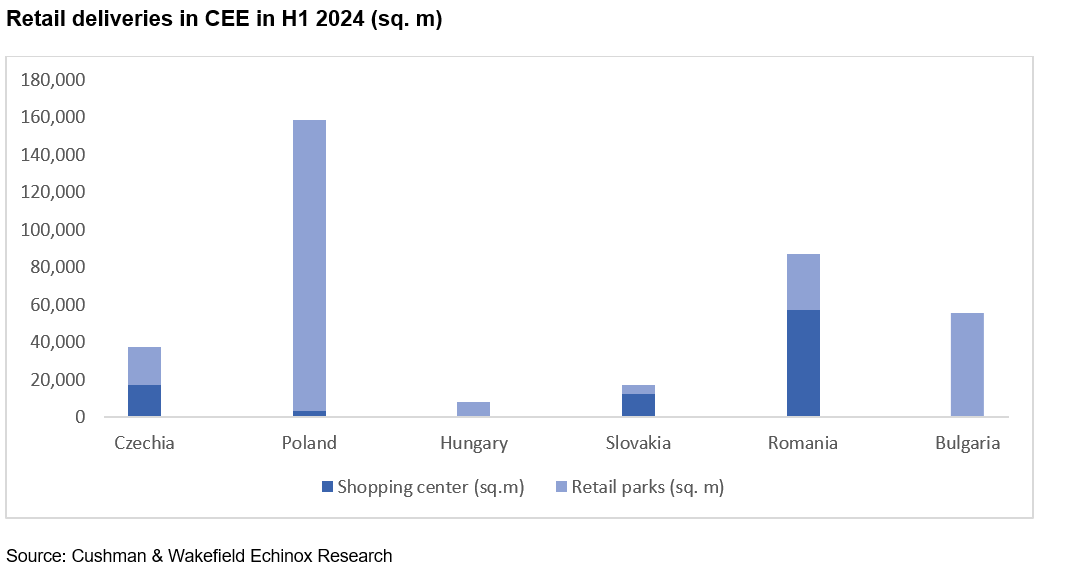

Dana Radoveneanu, Head of Retail Agency: “Romania remains an important retail destination in Central and Eastern Europe (CEE), as developers continue to invest in new projects to support the retailers’ expansion plans. Whether there are retail parks, built mainly in smaller cities or shopping centers located in regional hubs, the retail sector is highly dynamic, in a context where Romania was the second most important beneficiary of such investments in CEE across H1, after Poland”.

Dana Radoveneanu, Head of Retail Agency: “Romania remains an important retail destination in Central and Eastern Europe (CEE), as developers continue to invest in new projects to support the retailers’ expansion plans. Whether there are retail parks, built mainly in smaller cities or shopping centers located in regional hubs, the retail sector is highly dynamic, in a context where Romania was the second most important beneficiary of such investments in CEE across H1, after Poland”.

360,000 sq. m of retail spaces were delivered in CEE during H1, with retail parks having a share of almost 80% (274,000 sq. m). Only 85,000 sq. m of shopping centers were completed in the region during this period, with Romania being dominant in this regard (60% share).

There were no major changes pertaining to rental levels in Q2. The prime shopping center rent in Bucharest stood at €80 – 85/ sq. m/ month for a 100 – 150 sq. m unit located in a dominant project, while the corresponding figures in secondary cities, such as Cluj – Napoca, Timisoara, Iasi and Constanta were ranging between €50 – 65/ sq. m/ month, the same situation being observed in tertiary locations, where levels between €30 – 35/ sq. m/ month were recorded.