European Outlook 2026

Bucharest, October 2024: The total stock of industrial and logistics spaces in Romania could reach the 8 million sq. m threshold at the end of 2025, if the recent annual development pace of ~500,000 sq. m is maintained. As of mid-year, over 7.125 million sq. m were operational nationwide, with more than 50% of these projects being located in the Bucharest – Ilfov and West regions of the country. The least developed regions in this regard are South – East and North – East, according to the Romania Industrial & Logistics Market report produced by the Cushman & Wakefield Echinox real estate consultancy company.

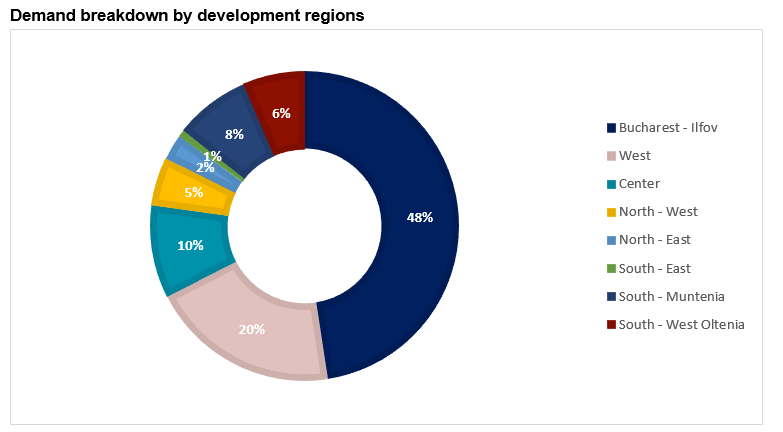

Even though a diversification of destinations benefiting from such investments has been observed in the last few years, driven by the sustained demand from logistics and retail companies, as well as from infrastructure investments, the major regional hubs remain Bucharest – Ilfov (49.2%) and the West (14.7%), South – Muntenia (10.6%), Center (9%) and North – West (8.9%) regions.

On the other hand, North – East (3.3% share) and South – East (1.7%) are the least developed regions, as the stock in Chitila (near Bucharest), for example, is comparable to the ones in the abovementioned regions.

The total 2024 new supply is due to reach around 500,000 sq. m, out of which over 50% are located in Bucharest – Ilfov, West and South – Muntenia.

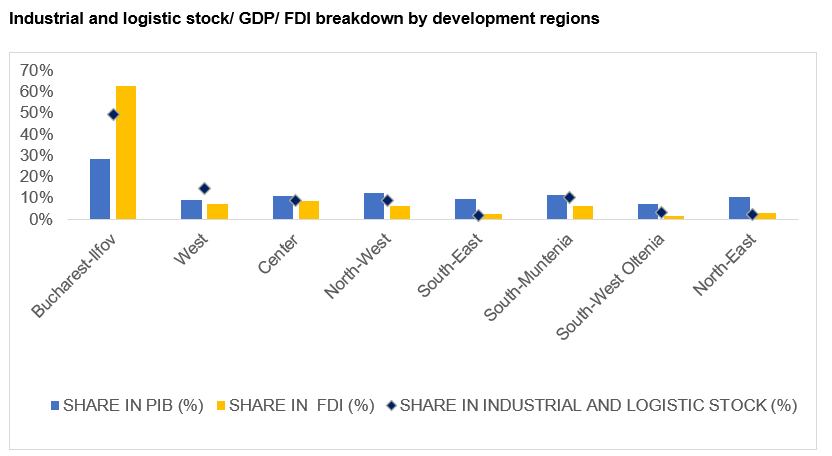

Vlad Saftoiu, Head of Research at Cushman & Wakefield Echinox: “The gap between the 8 development regions in terms of GDP share or the foreign direct investment inflows can also be noticed in the industrial and logistics stock distribution across the country. This real estate segment has been having a significant contribution towards the performance of champion areas in terms of business and foreign investment generation, providing the necessary infrastructure for numerous such developments. However, further investments in new industrial and logistics projects will mostly target areas with the best macroeconomic indicators. For this reason, we consider that it will be difficult to record a spectacular new supply surge on this segment, as long as the aforementioned gaps are not reduced.”

Vlad Saftoiu, Head of Research at Cushman & Wakefield Echinox: “The gap between the 8 development regions in terms of GDP share or the foreign direct investment inflows can also be noticed in the industrial and logistics stock distribution across the country. This real estate segment has been having a significant contribution towards the performance of champion areas in terms of business and foreign investment generation, providing the necessary infrastructure for numerous such developments. However, further investments in new industrial and logistics projects will mostly target areas with the best macroeconomic indicators. For this reason, we consider that it will be difficult to record a spectacular new supply surge on this segment, as long as the aforementioned gaps are not reduced.”

The transactional activity remained at a high level, with companies leasing approximately 1.5 million sq. m between 2023 – H1 2024.

Given that over 520,000 sq. m of new spaces were built nationwide during the same period, the vacancy rate dropped below 5%, thus offering development opportunities even in areas with a reduced modern industrial and logistics stock.

Bucharest – Ilfov had the highest share in the leasing volume over the past 18 months (48%), followed by the West (20%) and the Center (10%) regions.

The largest owners of industrial and logistics spaces are CTP and WDP, which have a cumulative portfolio of almost 5 million sq. m, thus controlling around two-thirds of the market.

However, other developers, such as VGP, ELI Parks, Logicor or Oresa Industra show a growing appetite for expansion. Furthermore, a series of new players have shown clear plans to enter the Romanian market, a premiere during the last few years, plans which are likely to materialize by the end of 2024/ beginning of 2025.