Romania Investment Marketbeat H2 2025

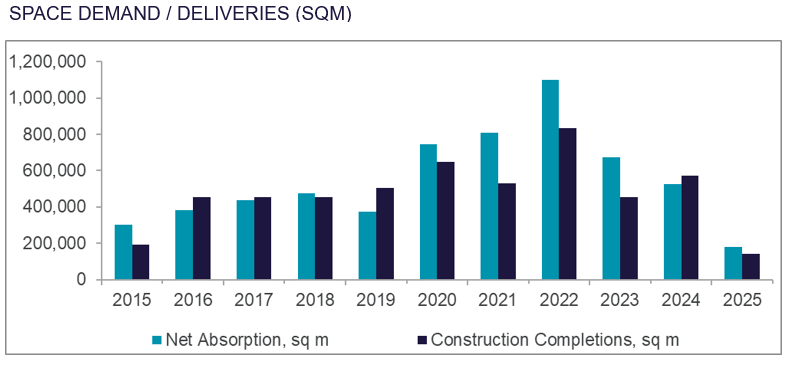

Bucharest, May 2025: The industrial and logistics market had a promising start of the year, with almost 260,000 sq. m being leased in Q1, corresponding to a robust 31% y-o-y increase, according to the Romania Marketbeat Industrial Q1 2025 report produced by the Cushman & Wakefield Echinox real estate consultancy company.

Another positive sign was related to the increase of the net take-up share in the overall leasing volume, to a level of 70% (181,000 sq. m) in Q1 2025, compared with 59% in Q1 2024 and vs 62% in Q4 2024.

Rodica Târcavu, Partner Industrial Agency Cushman & Wakefield Echinox: “We are glad that Romania manages to maintain a sustained pace of development in the current volatile climate, with many economic and geopolitical challenges, both nationally and globally, showing both attractiveness and confidence towards developers, but also towards companies active in different sectors – distribution, logistics, and also production. Although there are several players who are adopting a more cautious approach and who have decided to restructure/ streamline their production activities, there is also a wide range of companies which continue to believe in the potential of the Romanian market on the medium and long terms, considering it an attractive destination for investments. We are specifically referring to large production facilities which have recently expanded – De Longhi in Satu Mare (HORECA), Heco – automotive industry components/ screws in Campia Turzii, Trendyol and LPP on the retail segment – in Bucharest, NewCold – logistics/ distribution of frozen products – Bucharest.”

Rodica Târcavu, Partner Industrial Agency Cushman & Wakefield Echinox: “We are glad that Romania manages to maintain a sustained pace of development in the current volatile climate, with many economic and geopolitical challenges, both nationally and globally, showing both attractiveness and confidence towards developers, but also towards companies active in different sectors – distribution, logistics, and also production. Although there are several players who are adopting a more cautious approach and who have decided to restructure/ streamline their production activities, there is also a wide range of companies which continue to believe in the potential of the Romanian market on the medium and long terms, considering it an attractive destination for investments. We are specifically referring to large production facilities which have recently expanded – De Longhi in Satu Mare (HORECA), Heco – automotive industry components/ screws in Campia Turzii, Trendyol and LPP on the retail segment – in Bucharest, NewCold – logistics/ distribution of frozen products – Bucharest.”

Bucharest had a dominant 65% share in the total Q1 demand, followed by Timisoara with 12%, these cities also being the largest industrial and logistics destinations in Romania.

The largest transaction signed in the analyzed period pertained to Delamode’s renegotiation and expansion in CTPark Bucharest (31,000 sq. m in total). LPP also expanded its footprint in CTPark Bucharest West with an extra 23,000 sq. m, while the Dutch company NRF leased 20,100 sq. m in MLP Bucharest West. RPW Logistics completed the largest transaction outside Bucharest, namely a renegotiation of their current contract – 15,700 sq. m in VGP Park Timisoara.

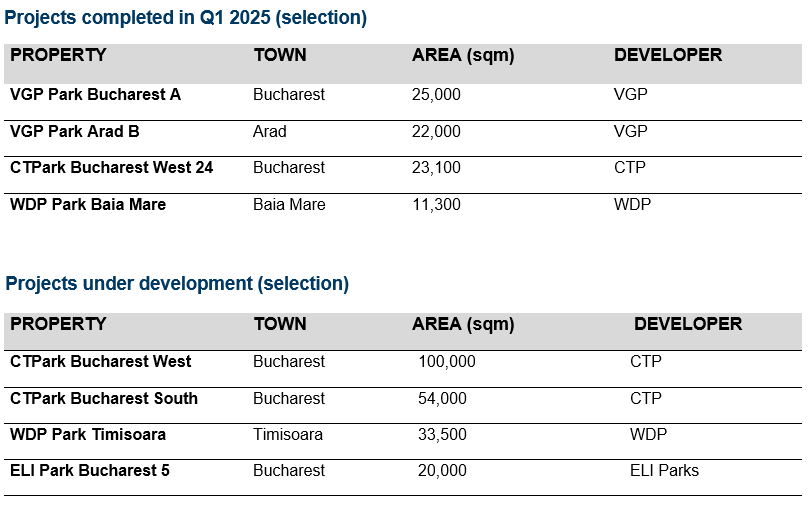

The total industrial and logistics stock Romania reached 7.71 million sq. m at the end of Q1, a quarter when developers completed new projects with a leasable area of 142,000 sq. m across the country.

In terms of supply, Bucharest benefited from the completion of new projects totaling approximately 50,000 sq. m, while other important deliveries were noted in cities such as Pitesti (22,000 sq. m), Timisoara and Brasov (12,000 sq. m each) or Baia Mare (11,000 sq. m).

The industrial and logistics stock in the country is very likely to reach the 8 million sq. m threshold by the end of the year, given that the current under construction pipeline is of approximately 345,000 sq. m. New projects of more than 230,000 sq. m are under development around Bucharest, as the total stock in the capital city is rapidly approaching the 4 million sq. m benchmark.

The nationwide vacancy rate increased to a level of 5.6%, but a downward movement is expected in the coming quarters due to the relatively low number of speculative projects under construction.

The prime headline rents in Bucharest and in the main industrial and logistics destinations in Romania have generally remained flat, ranging between €4.20 – 4.70/ sq. m/ month in Q1, with lower asking rents in locations with higher vacancy rates. The rental levels are expected to see minor movements in the coming period, with a series of upward developments for the new projects which are facing increasing construction costs and land acquisition prices.