European Outlook 2026

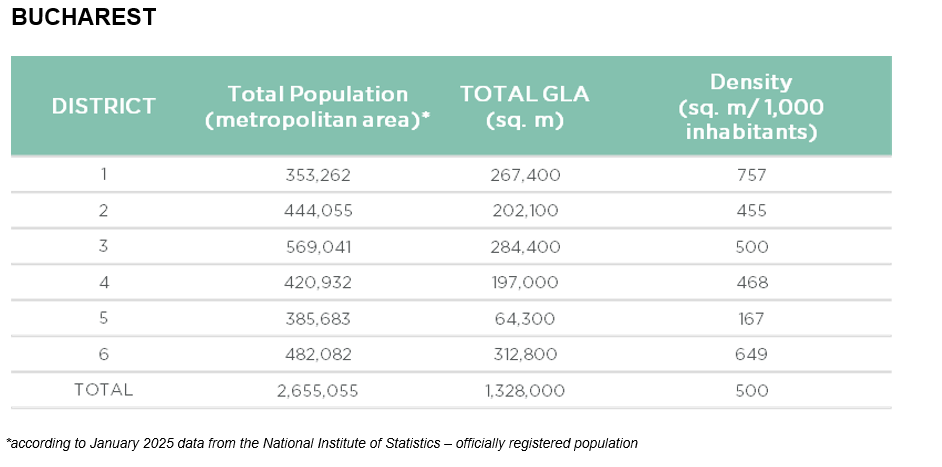

Bucharest, August 2025: The Romanian retail market has been very active throughout H1 2025, when projects totaling more than 162,000 sq. m were delivered. The modern retail stock in the country reached 4.73 million sq. m, with the largest share located in the Central – West region (16 counties in Transylvania and Banat), totaling approximately 1.56 million sq. m (33% of the national stock), followed by Bucharest – Ilfov with 1.33 million sq. m (28%), according to the Bucharest Retail Market and Romania Retail Regional Cities reports released by the Cushman & Wakefield Echinox real estate consultancy company.

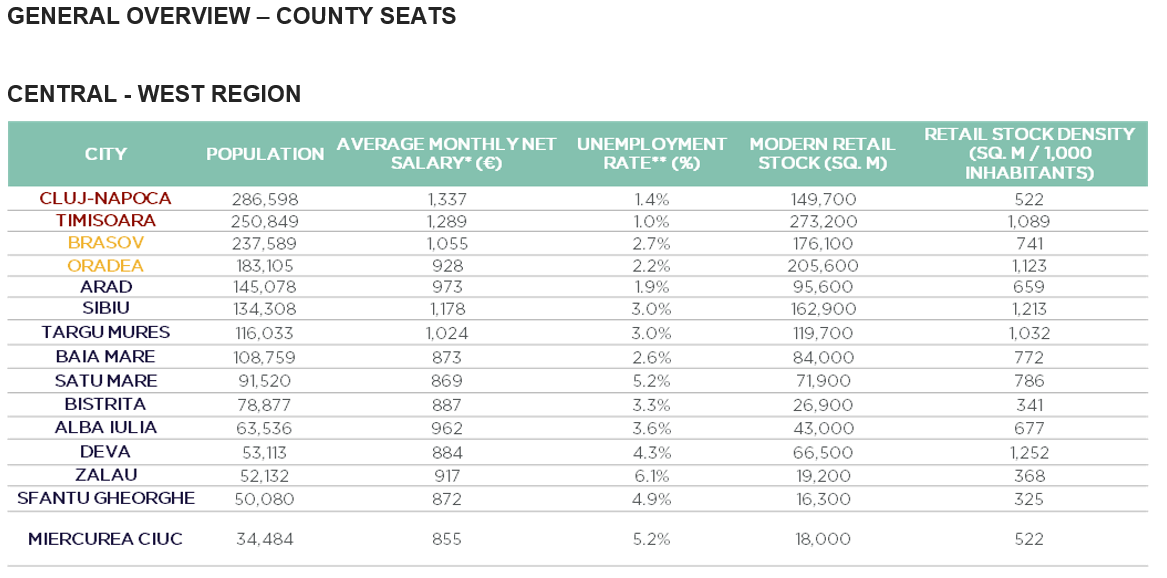

The modern retail stock in the Central – West region is 17% higher than the Bucharest – Ilfov one and more than double compared with the corresponding one in the East (Moldova) region (8 counties), which reached approximately 735,000 sq. m.

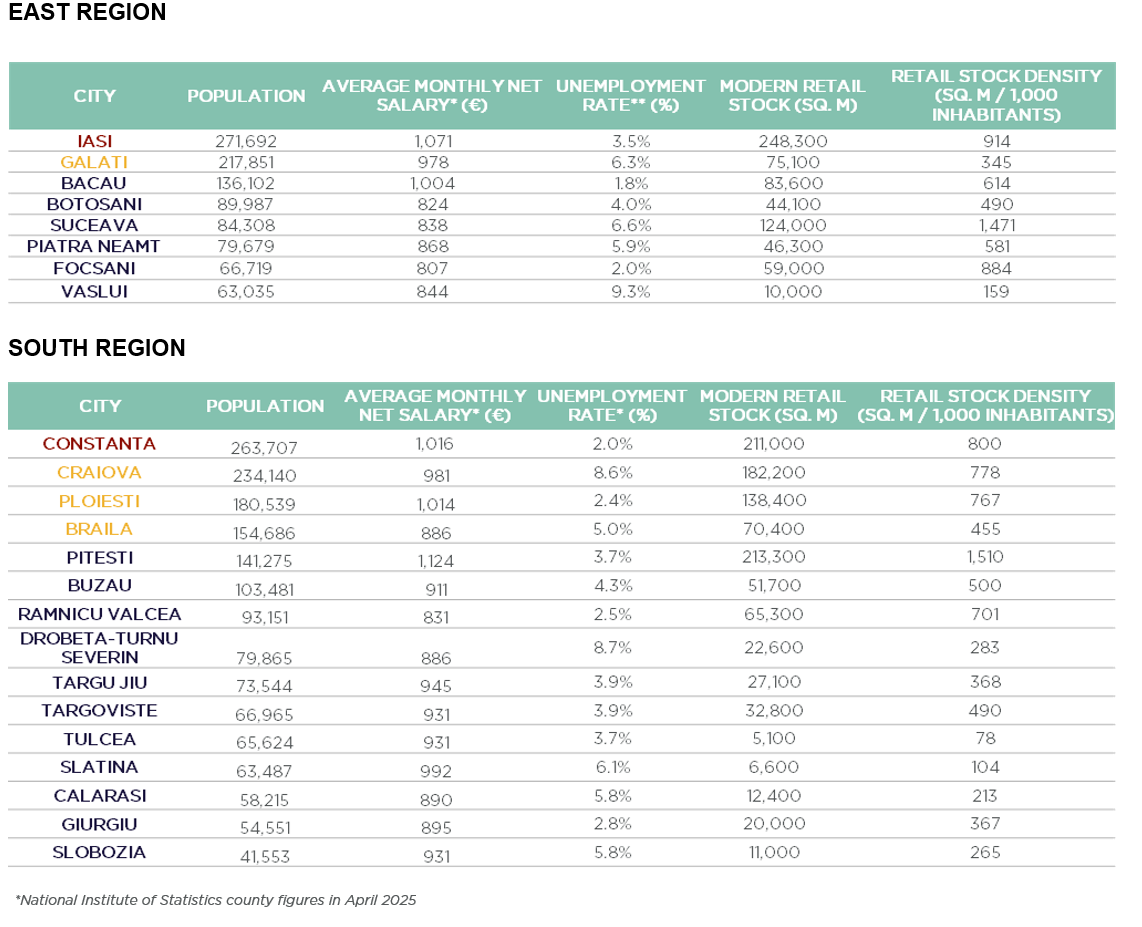

Another analyzed region is South (16 counties, excluding Bucharest – Ilfov), which has a cumulated modern retail stock of 1.1 million sq. m located in shopping centers, retail parks and commercial galleries.

The retail density at national level is of 248 sq. m/ 1,000 inhabitants, still one of the lowest in Europe.

At a city-based level, the highest retail space density can be found in Pitesti (1,510 sq. m/ 1,000 inhabitants), Suceava (1,471 sq. m/ 1,000 inhabitants), Deva (1,252 sq. m/ 1,000 inhabitants), Sibiu (1,213 sq. m / 1,000 inhabitants), Oradea (1,123 sq. m/ 1,000 inhabitants) – all cities with less than 150,000 inhabitants, and Timisoara (1,089 sq. m/ 1,000 inhabitants) – the only one with a population of over 250,000 inhabitants.

In other cities with a population exceeding 250,000 this indicator varies between 522 sq. m/1,000 inhabitants in Cluj – Napoca to 914 sq. m/1,000 inhabitants in Iasi.

The H1 2025 new supply increased by over 80% compared with the same period last year, with Mall Moldova, a super-regional shopping center in Iasi (125,700 sq. m) and the Iulius Mall Suceava extension (16,500 sq. m) being the most important projects completed in that period.

Moreover, the Romanian retail market is projected to continue its growth in a context where more than 700,000 sq. m of new projects are in different development stages across the country and are due to be completed by the end of the decade. The Central – West region, particularly Cluj – Napoca and Resita, is set to attract ~60% of these deliveries, while the East (notably Bacau and Galati) accounts for 16% of the national pipeline.

South has a lower pipeline of 65,000 sq. m, with Tulcea and Giurgiu being among the targeted cities. Meanwhile, Bucharest has 46,000 sq. m of new retail premises currently under construction.

The most active developers in the coming period will be Prime Kapital, Iulius Group and NEPI Rockcastle — all among the largest owners of retail spaces on the local market.

Dana Radoveneanu, Head of Retail Agency, Cushman & Wakefield Echinox: “The Romanian retail market is undergoing an accelerated expansion, driven by the developers’ overarching strategies aimed at growing their portfolios, and by the low retail density in many secondary and tertiary cities. While Bucharest remains a key market, the Central – West region has taken the lead nationally. These two areas, which account for approximately 45% of the country’s population and where some of the highest wages are registered, have a combined share of more than 50% of Romania’s modern retail stock. Meanwhile, Moldova — currently the least developed region in this regard — is taking significant steps to close the gap, emerging as a strategic target for future projects led by major developers.”

Dana Radoveneanu, Head of Retail Agency, Cushman & Wakefield Echinox: “The Romanian retail market is undergoing an accelerated expansion, driven by the developers’ overarching strategies aimed at growing their portfolios, and by the low retail density in many secondary and tertiary cities. While Bucharest remains a key market, the Central – West region has taken the lead nationally. These two areas, which account for approximately 45% of the country’s population and where some of the highest wages are registered, have a combined share of more than 50% of Romania’s modern retail stock. Meanwhile, Moldova — currently the least developed region in this regard — is taking significant steps to close the gap, emerging as a strategic target for future projects led by major developers.”

The only significant Q2 upward rental movements were related to the prime high street spaces on Calea Victoriei in Bucharest, which are now quoted at a level of €70/ sq. m/ month and further increases are expected in the coming quarters, while the corresponding figures for shopping centers in Bucharest and in the main secondary locations remained stable, ranging between €50 – 90/ sq. m/ month.