CEE Office MarketBeat Report Q3 2025

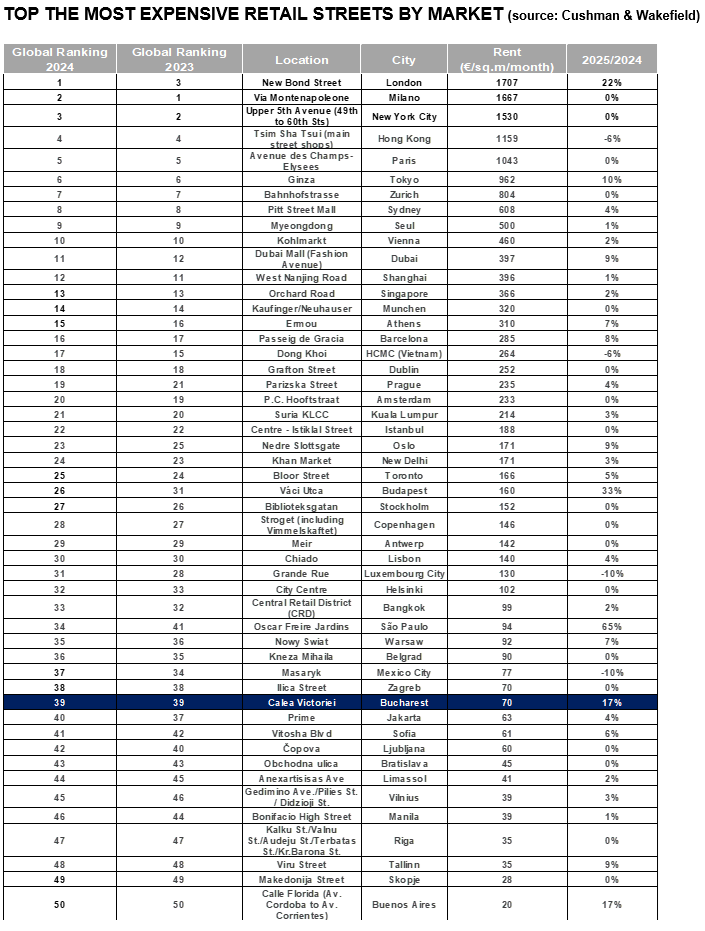

Bucharest, November 2025 – Rents in Calea Victoriei, the main retail street in Bucharest, recorded the 3rd highest growth among the 50 analysed markets worldwide in the latest edition of the “Main Streets Across the World” report by Cushman & Wakefield.

Calea Victoriei boasts a prime rental level of €70/ sq. m/ month, 17% higher compared with last year, as Bucharest ranks 39th worldwide and 24th in Europe, on par with Zagreb.

Rents in Prague (€235/ sq. m/ month), Budapest (€160/ sq. m/ month), Warsaw (€92/ sq. m/ month) Belgrade (€90/ sq. m/ month), were above the Bucharest benchmark, with lower values being recorded in Sofia (€61/ sq. m/ month), Bratislava (€45/ sq. m/ month), Vilnius (€39/ sq. m/ month), Riga and Tallin (€35/ sq. m/ month) or Skopje (€28/ sq. m/ month).

London’s New Bond Street, where rents have risen by 22% in the past year to €1,707 / sq. m/ month, has been crowned the world’s most expensive retail destination for the first time. New Bond Street has leapfrogged Milan’s Via Montenapoleone (€1,667 / sq. m/ month), which last year became the first European street to top the global rankings, and New York’s iconic Upper Fifth Avenue (€1,530 / sq. m/ month), in the 2025 edition of the report.

Using Cushman & Wakefield’s proprietary data, the report focuses on headline rents in 141 best-in-class urban locations across the world which, in many cases, are linked to the luxury sector. It includes a global index ranking the most expensive destination in each market.

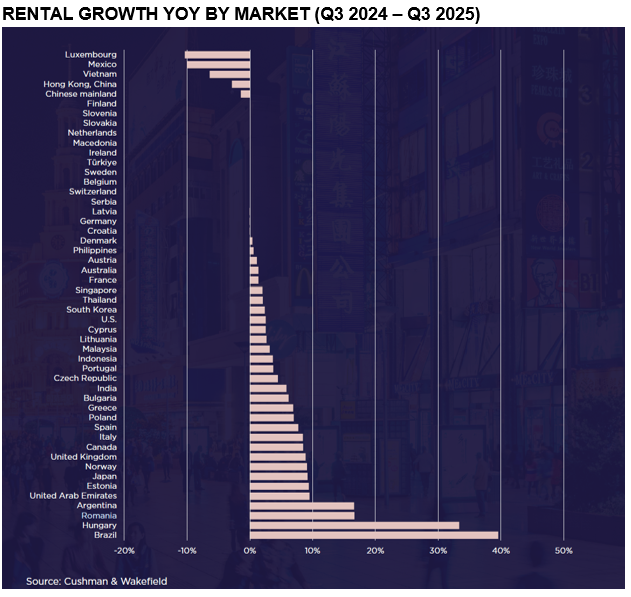

Globally, rents grew on average at 4.2% with 58% of markets experiencing rental growth. The Americas led regional rental growth at 7.9%, driven by currency effects in South America. Europe experienced steady 4% year-on-year (y-o-y) growth, with standout performances in Budapest and London. Meanwhile rents in Asia Pacific slowed to 2.1%, with strong growth in India and Japan offset by economic headwinds in Greater China and Southeast Asia.

London led the resurgence in rents in Europe, with New Bond Street (+22%), Oxford Street, and Regent Street all recording double-digit increases. Budapest’s Fashion Street was the region’s standout performer, with a 33% rise, overtaking Vaci utca as the city’s premier retail destination. Milan and Paris maintained their global status with stable rents on Via Montenapoleone (€1,667 / sq. m/ month) and Champs Elysées (€1,043 / sq. m/ month)

The Americas remained the strongest performing region overall, with average rent growth of 7.9%. Sao Paulo’s Oscar Freire Jardins in Brazil seeing a remarkable 65% increase, climbing seven places in the global rankings. In North America, rental growth was more subdued, with the United States averaging 2.5%. While New York’s Upper Fifth Avenue remained flat, neighbouring Madison Avenue and SoHo recorded growth of over 8%.

Prime retail destinations continue to outperform broader market trends, demonstrating resilience amid economic uncertainty and shifting consumer behaviour.

Dana Radoveneanu, Head of Retail Agency Cushman & Wakefield Echinox: “The retail sector is undergoing a dynamic transformation driven by sustained demand for physical experiences. Furthermore, the appetite for appetite for physical retail space is as strong now as it ever was, with location continuing to be a key factor, even amid volatility. Although the luxury retail market in Romania is still emerging within Europe, continued investment from international brands and retail developers is enhancing the appeal of iconic streets. Calea Victoriei, the only commercial street in Romania included in this global ranking, continues to attract luxury retailers. Establishing a presence on this street, in the heart of Bucharest, is a strategic move that provides a significant competitive advantage”.

Dana Radoveneanu, Head of Retail Agency Cushman & Wakefield Echinox: “The retail sector is undergoing a dynamic transformation driven by sustained demand for physical experiences. Furthermore, the appetite for appetite for physical retail space is as strong now as it ever was, with location continuing to be a key factor, even amid volatility. Although the luxury retail market in Romania is still emerging within Europe, continued investment from international brands and retail developers is enhancing the appeal of iconic streets. Calea Victoriei, the only commercial street in Romania included in this global ranking, continues to attract luxury retailers. Establishing a presence on this street, in the heart of Bucharest, is a strategic move that provides a significant competitive advantage”.