Romania Investment Marketbeat H2 2025

Bucharest, February 2026: Retail developers continue to accelerate their expansion plans across Romania, as projects cumulating more than 750,000 sq. m GLA are currently in different construction and planning stages, being due for delivery until 2029, according to the Romania Retail Marketbeat Q4 2025 published by the Cushman & Wakefield Echinox real estate consultancy company.

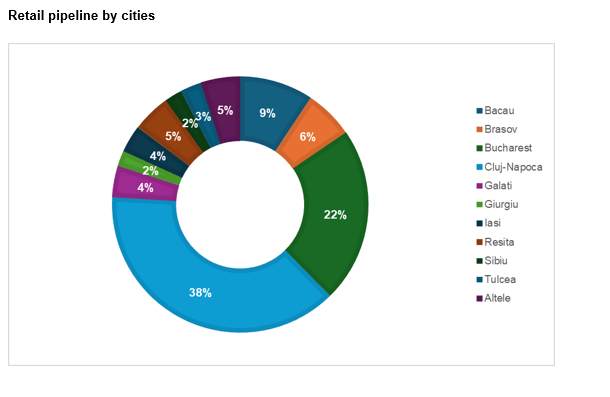

NEPI Rockcastle, Iulius Group – Atterbury Europe, MAS RE – Prime Kapital, M Core, and Scallier remain among the most active developers, while the investment plans target Bucharest (22% of the total pipeline) and major regional cities such as Cluj-Napoca (38%), Brasov (6%), and Iasi (4%), as well as tertiary destinations including Bacău (9%), Reșița (5%), Sibiu (2%), Galați (4%), Giurgiu (2%), and Tulcea (3%).

If all these projects are completed, Romania’s modern retail stock is expected to exceed 5.6 million sq. m by the end of 2029, an increase of at least 16% compared with the current 4.8 million sq. m. Approximately 1.33 million sq. m of the retail spaces in question are in Bucharest, with the rest being spread across the country (the stock mainly includes projects with a gross leasable area of more than 5,000 sq. m).

The total 2025 new supply reached 208,000 sq. m, a volume 16% above than the corresponding one for 2024 and one of the highest ever in Romania.

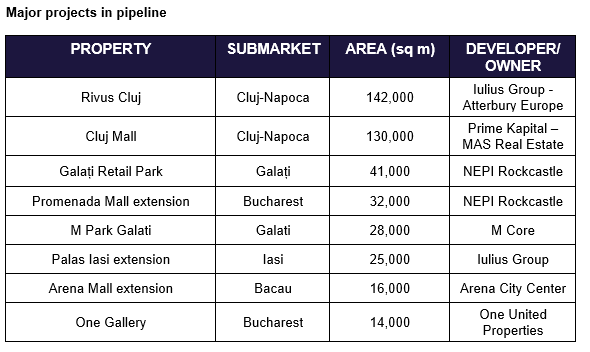

A total of 10 projects were completed last year, including new schemes and extensions of existing properties, in Bucharest, Iasi, Suceava, Arad, Ploiesti, Hunedoara, Curtea de Arges, Orastie, Sibiu, and Cisnadie.

Notably, Bucharest saw the completion of one of the largest luxury destinations in the country in 2025 – TOFF Galleries (Stirbei Palace) – adding approximately 4,000 sq. m of premium retail space on Calea Victoriei.

In terms of volume, 68% of the 2025 completed spaces were in shopping centers, with the remaining ones located retail parks and commercial galleries — a complete reversal from 2024, when retail parks accounted for 64% of the annual volume.

The largest retail project delivered in 2025 was Mall Moldova in Iasi, totaling 125,700 sq. m and developed by Prime Kapital & MAS Real Estate. Other notable completions included Agora Mall Arad (36,000 sq. m – major refurbishment of the former Galleria Arad) and the 16,500 sq. m extension of Iulius Mall Suceava.

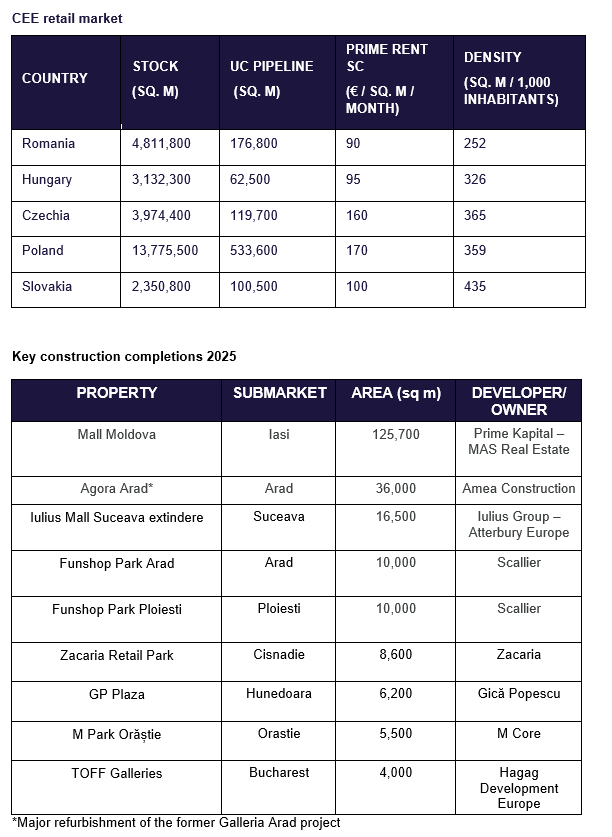

The strong development activity recorded in the last few years positioned Romania as the second-largest modern retail market in the region, after Poland (13.8 million sq. m).

However, when adjusting for population, Romania remains the lowest-density retail market in CEE, with 252 sq. m / 1,000 inhabitants, compared with 435 in Slovakia, 365 in the Czech Republic, 359 in Poland, and 326 in Hungary.

The only significant rental growth for prime units in Q4 has been observed for high street spaces on Calea Victoriei, which are now quoted at €80 / sq. m/ month (+ 33 % y-o-y, an impressive upward trend which came as a result of a number of major store openings), while the dominant shopping centers in Bucharest and in the main secondary locations achieve rental revenues ranging between € 50 – 90 / sq . m/ month for 100 – 200 sq. m for ground floor spaces.

Dana Radoveneanu, Head of Retail, Cushman & Wakefield Echinox: ”The retailers’ expansion appetite remains strong, and Romania continues to stand out as a high‑potential market despite a still‑volatile economic environment. Demand for well‑positioned retail locations is supported by the retailers’ solid performance, as well as by encouraging inflation forecasts, which are expected to strengthen the consumer purchasing power in the coming period. All these factors create a favorable outlook for the retail sector and assist the development plans of both operators and investors.”

Dana Radoveneanu, Head of Retail, Cushman & Wakefield Echinox: ”The retailers’ expansion appetite remains strong, and Romania continues to stand out as a high‑potential market despite a still‑volatile economic environment. Demand for well‑positioned retail locations is supported by the retailers’ solid performance, as well as by encouraging inflation forecasts, which are expected to strengthen the consumer purchasing power in the coming period. All these factors create a favorable outlook for the retail sector and assist the development plans of both operators and investors.”