Construction Insights 2026

Bucharest, March 2024: Bucharest ranks among the major European cities with the lowest housing prices and the highest affordability ratios, according to data from the Cushman & Wakefield Echinox real estate consultancy company. The expected increases in wages as a result of the positive economic developments and also the easing of financing conditions are likely to favor house prices’ increases, a trend which will probably start manifesting itself in a more pronounced way from 2025 onwards.

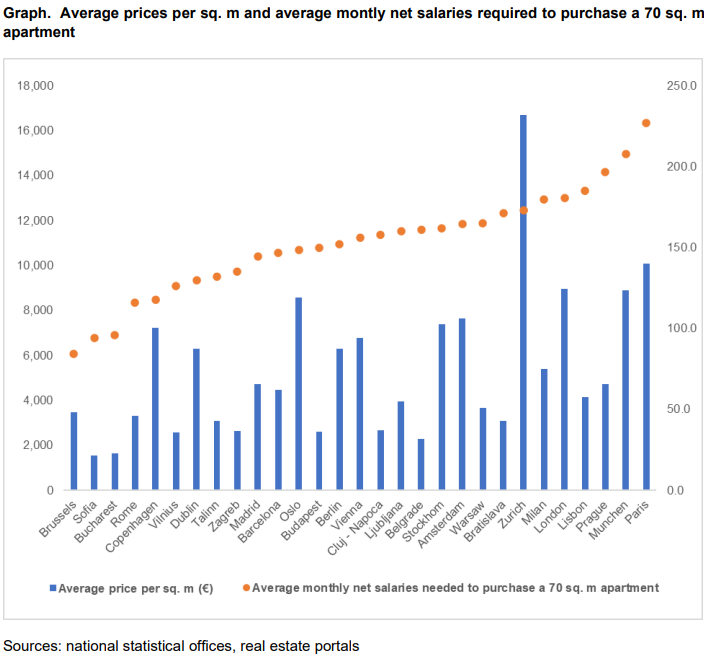

Based on the public data available in regards to the average residential prices in Europe, the affordability level in Bucharest is among the highest both nationally and across the continent, with only 96.2 average monthly net salaries being required to purchase a 70 sq. m apartment. Higher levels of affordability are only recorded in Brussels and Sofia (84.2 and 94.3 average net salaries, respectively) among the major European cities and capitals. London, Munich, Paris or Zurich have some of the highest average asking prices which can exceed €10,000 (Paris) or €16,000 (Zurich) per sq. m, generally requiring more than 200 average monthly net salaries from those locations in order to purchase a 70 sq. m apartment, a level more than double compared with Bucharest.

Furthermore, the capital city of Romania also offers favorable residential prices at CEE level, with lower affordabilities being registered in Prague (the average asking prices exceed €4,700/ sq. m and 196.7 average net salaries are needed), Bratislava (171.5 salaries), Warsaw (165.3), Belgrade (161),

Vlad Săftoiu, Head of Research at Cushman & Wakefield Echinox: “The residential property prices in Romania have seen significant upward movements in 2023 in cities such as Cluj – Napoca, Brasov, Oradea, Iasi or Craiova, with double digit increases in most of the mentioned locations. Bucharest has somewhat diverged in the last 12 – 24 months, a period during which the average growth of the asking prices was clearly below the inflation rate and the construction costs’ increases. Moreover, we have witnessed a clear residential market rebound in H2 2023 and in the first months of 2024, after a moment when the number of transactions with residential units had significantly decreased during H1 2023, due to the high housing loans’ interest rates. Banks have initiated a series of offers with more favorable interest rates, below the 7% monetary policy rate set by the National Bank, in order to restart mortgage lending. We are currently noticing offers in the market with annual fixed interest rates ranging between 5.6 – 5.85% for a period of 3 – 5 years, a level similar to those currently registered in Western Europe and which, combined with the higher housing affordability in Bucharest compared with most major European cities, will create an extremely favorable framework for further developments of large-scale residential projects in the capital city, as well as for price increases on the medium and long terms.”

Vlad Săftoiu, Head of Research at Cushman & Wakefield Echinox: “The residential property prices in Romania have seen significant upward movements in 2023 in cities such as Cluj – Napoca, Brasov, Oradea, Iasi or Craiova, with double digit increases in most of the mentioned locations. Bucharest has somewhat diverged in the last 12 – 24 months, a period during which the average growth of the asking prices was clearly below the inflation rate and the construction costs’ increases. Moreover, we have witnessed a clear residential market rebound in H2 2023 and in the first months of 2024, after a moment when the number of transactions with residential units had significantly decreased during H1 2023, due to the high housing loans’ interest rates. Banks have initiated a series of offers with more favorable interest rates, below the 7% monetary policy rate set by the National Bank, in order to restart mortgage lending. We are currently noticing offers in the market with annual fixed interest rates ranging between 5.6 – 5.85% for a period of 3 – 5 years, a level similar to those currently registered in Western Europe and which, combined with the higher housing affordability in Bucharest compared with most major European cities, will create an extremely favorable framework for further developments of large-scale residential projects in the capital city, as well as for price increases on the medium and long terms.”

Data provided by the National Commission for Strategy and Prognosis and by the major international credit institutions illustrates a significant economic growth potential in the coming years in Romania, a forecast which will also translate into important wage increases in Bucharest and in the main social and economic hubs in the country. The average monthly net salary in Bucharest is estimated to reach approximately €1,600 in 2027 (+32% compared with the 2023 average), an indicator which will also have a positive impact on the housing affordability, especially against the backdrop of anticipated downward shifts of the key interest rates, shifts which will gradually begin from 2024 and which are likely to continue in the coming years.

The average asking price for a listed apartment in Bucharest was of €1,663/ sq. m in February, according to imobiliare.ro, Romania’s largest residential portal. This level corresponds to a 6.6% increase compared with February 2023 and to a 7.5% increase vs. the same month in 2022, representing some of the lowest upward price movements during the analyzed periods in the country. Bucharest ranks only third in terms of the highest average residential prices in Romania after Cluj – Napoca (€2,666/ sq. m, +10.4% vs February 2023) and Brasov (€1,815/sq. m, +14.9% vs February 2023).

The average asking price for a listed apartment in Bucharest was of €1,663/ sq. m in February, according to imobiliare.ro, Romania’s largest residential portal. This level corresponds to a 6.6% increase compared with February 2023 and to a 7.5% increase vs. the same month in 2022, representing some of the lowest upward price movements during the analyzed periods in the country. Bucharest ranks only third in terms of the highest average residential prices in Romania after Cluj – Napoca (€2,666/ sq. m, +10.4% vs February 2023) and Brasov (€1,815/sq. m, +14.9% vs February 2023).

Cushman & Wakefield Echinox is a leading real estate company on the local market and the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, with a team of over 80 professionals and collaborators offering a full range of services to investors, developers, owners and tenants.

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2023, the firm reported revenue of $9.5 billion across its core services of property, facilities and project management, leasing, capital markets, and valuation and other services. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity and Inclusion (DEI), sustainability and more. For additional information, visit www.cushmanwakefield.com.