Construction Insights 2026

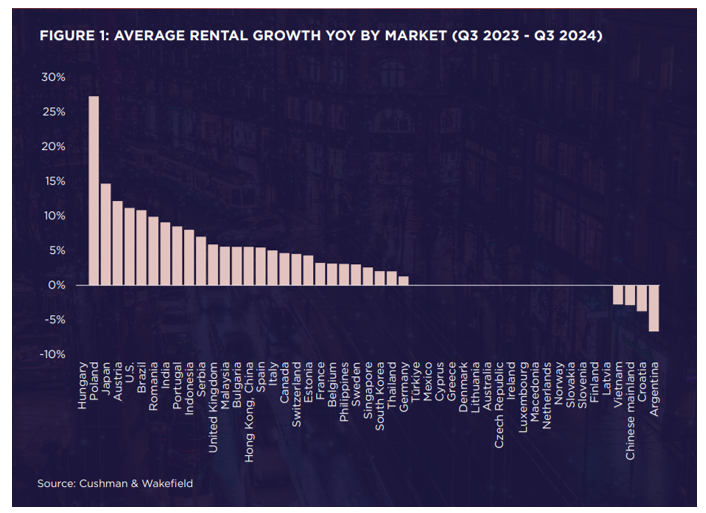

Bucharest, November 2024 – Calea Victoriei in Bucharest climbs two positions, up to the 38th place, in the ranking of the most expensive commercial streets across the world, as rents in Bucharest recorded the 7th highest growth among the 138 analysed markets worldwide, in the latest edition of the “Main Streets Across the World” report by Cushman & Wakefield.

Calea Victoriei, the main retail street in the city, boasts a prime rental level of €60/ sq. m/ month, 9% higher compared with last year, as Bucharest ranks 38th worldwide and 23rd in Europe, on par with Ljubljana.

Rents in Prague (€225/ sq. m/ month), Budapest (€140/ sq. m/ month), Belgrade (€90/ sq. m/ month), Warsaw (€86/ sq. m/ month) and Zagreb (€70/ sq. m/ month) were above the Bucharest benchmark, with lower values being recorded in Sofia (€57/ sq. m/ month), Bratislava (€45/ sq. m/ month), Vilnius (€37/ sq. m/ month), Riga (€35/ sq. m/ month) or Skopje (€28/ sq. m/ month).

Milan’s Via Montenapoleone (€1,667/ sq. m/ month) overtook New York City’s Fifth Avenue (€1,628/ sq. m/ month) as the world’s most expensive retail destination; the change marks Europe’s first time at the top in the report’s history, which reached the 34th edition. This reflects a robust rental growth for the reputed Italian street, exceeding 30% in the last two years, further bolstered this year by the euro’s appreciation against the U.S. dollar.

Other changes occurred in relation with the 3rd place, with London’s New Bond Street leapfrogging Tsim Sha Tsui in Hong Kong, pushing the latter on the 4th spot, despite positive rental growth this year.

Avenue des Champs-Elysees in Paris retained the 5th position, but the gap to 6th narrowed, following a 25% y-o-y rental growth in Tokyo’s Ginza district.

In global terms, rents across the 138 tracked locations have crossed another benchmark, now being on average nearly 6% above pre-pandemic levels, thanks to a strong y-o-y growth of over 4%.

The retail sector not only demonstrates remarkable resilience year after year, but also proves its ability to adapt and evolve in response to changing macroeconomic conditions and customer requirements.

The retail sector has been buffeted by the broader economic conditions resulting from interest rate hikes in 2022 and 2023, aimed at combating strong inflation. Implications have included a rapid increase in the cost of living, weak consumer sentiment and sluggish economic growth. As a result of such headwinds, it is not surprising that luxury brands have experienced a notable slowdown in revenue growth from approximately 15% in 2022 to 0-4% in the current financial year.

Dana Radoveneanu, Head of Retail Agency Cushman & Wakefield Echinox: “Luxury retail in Bucharest continues to evolve, reflecting regional and global trends. Calea Victoriei, the main retail street in Romania, has seen a 9% increase in rents over the past year, one of the highest rates worldwide, indicating growing interest from international retailers. However, rents for premium spaces remain below the levels recorded in other Central European capital cities, such as Prague or Budapest. This dynamic, combined with a global slowdown of the luxury brands’ revenue growth, highlights both the economic challenges and opportunities which the Bucharest market can leverage in the coming years. There are already developers present in Romania who are betting on the growing interest of luxury brands towards the country and who are building retail facilities targeting this retail segment.”

Globally, 57% (79) of streets experienced positive rental growth, with just 14% (19) registering rental decline. The remaining 29% (40) were stable y-o-y.

The Americas continues to be the strongest performing region, propelled by a rental growth of almost 11% y-o-y in the U.S. – a significant increase from last year. In comparison, rental growth in Europe and Asia Pacific slowed, registering hikes of 3.5% and 3.1%, down from 4.2% and 5.3% (the last year’s performance), respectively.