Construction Insights 2026

Bucharest, September 2024: The net office take-up in Bucharest across Q2 exceeded the renewal and renegociation transactional volume for the first time during the last two years, with a positive impact on the average vacancy rate, given that no new office projects were delivered in H1, according to data from the Cushman & Wakefield Echinox real estate consultancy company.

Close to 77,000 sq. m of office spaces were leased in Bucharest during Q2 2024, while the net take-up had a significant rebound, with a 62% share in the transactional volume, the highest quarterly share since Q1 2022.

The leasing activity in H1 2024 was strong, with 168,000 sq. m being transacted in the capital city, thus marking a decrease of only 11% compared with H1 2023. The net demand accounted for 82,100 sq. m, an area which could accommodate around 8,000 employees. The average new lease transaction size was of more than 1,100 sq. m.

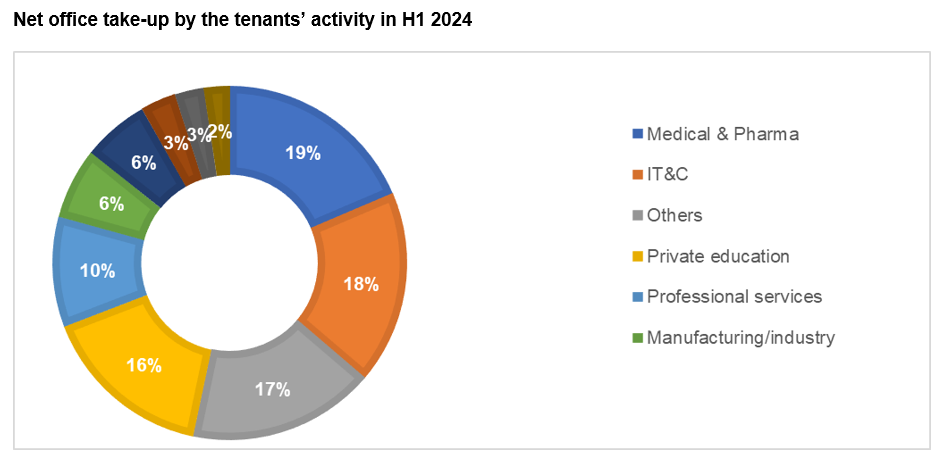

The medical & pharma sector was the most active, contracting 19% of the net leased area in H1 2024 (15,300 sq. m), followed by IT&C companies, with 18% (14,500 sq. m). Professional services operators, private education institutions and manufacturing/ industrial companies also contracted significant new offices in the analyzed period.

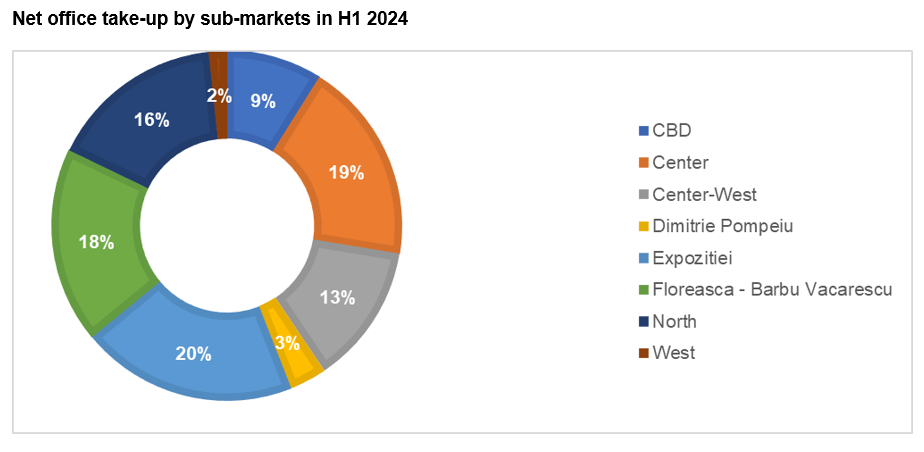

Madalina Cojocaru, Partner Office Agency Cushman & Wakefield Echinox: ”The office leasing activity improved across Europe in Q2 and H1 overall, as companies are adapting to the hybrid work model and more employees are returning to offices. We are optimistic in regards to the office space demand going forward, especially when it comes to premium A-class buildings. Tenants are actively searching well-located office buildings, offering a wide range of amenities for tenants, as well as with the latest ESG standards. For example, in the ultra-central areas such as Piata Victoriei, Aviatorilor, Floreasca or Dorobanti, the vacancy rate in A-class buildings has considerably decreased, reaching 5% or below, a level which reflects the robust interest for these spaces.”

Madalina Cojocaru, Partner Office Agency Cushman & Wakefield Echinox: ”The office leasing activity improved across Europe in Q2 and H1 overall, as companies are adapting to the hybrid work model and more employees are returning to offices. We are optimistic in regards to the office space demand going forward, especially when it comes to premium A-class buildings. Tenants are actively searching well-located office buildings, offering a wide range of amenities for tenants, as well as with the latest ESG standards. For example, in the ultra-central areas such as Piata Victoriei, Aviatorilor, Floreasca or Dorobanti, the vacancy rate in A-class buildings has considerably decreased, reaching 5% or below, a level which reflects the robust interest for these spaces.”

The overall vacancy rate in Bucharest continued to be on a downward trend similar to the last few quarters, reaching a level of 14.2%, with further decreases expected by year-end due to the very limited pipeline.

The prime headline rent in Bucharest’s CBD recorded a slight decrease of €0.50, settling at €21.50/ sq. m/ month in Q2, while other submarkets remained stable.

The under-construction pipeline remains limited at 88,400 sq. m GLA, with additional projects still in the permitting stages. New supply is expected to remain low in the coming years due to the high financing costs and also as a result of the ongoing urban planning issues at the municipal level.