Food Halls of Europe 2024/25 Edition

Bucharest, May 2024: The office market in Bucharest has shown a sustained demand growth in Q1, both in terms of the transacted volume and of the average lease size, amid an extremely limited new supply, according to data from the Cushman & Wakefield Echinox real estate consultancy company.

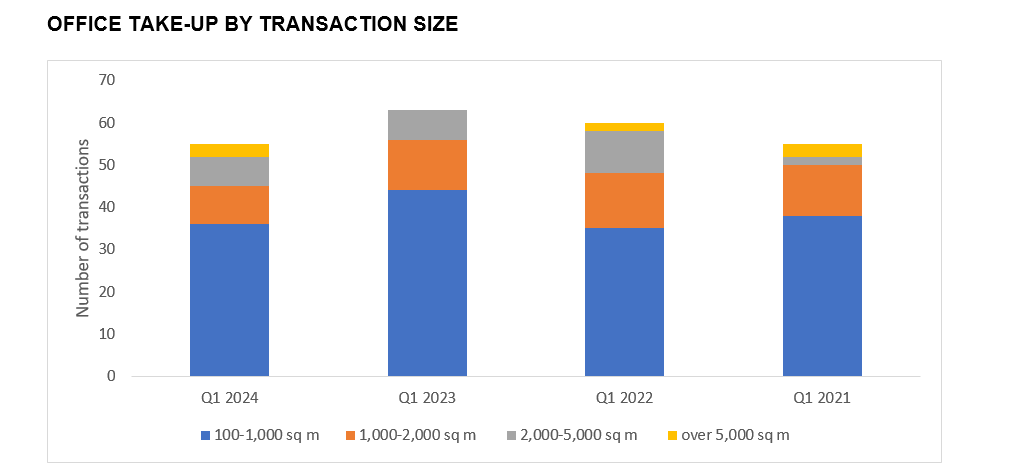

Companies leased 91,000 sq. m of office spaces in Bucharest in Q1, corresponding to a significant 63% y-o-y increase. A number of 55 transactions were concluded during the analyzed period, with an average deal size of 1,657 sq. m, twice the level of recorded in Q1 2023.

Transactions pertaining to areas of up to 1,000 sq. m accounted for the largest share (65% of the total), followed by those ranging between 1,000 – 2,000 sq. m (16%). Seven deals were signed for offices with an area between 2,000 – 5,000 sq. m, while three exceeded 5,000 sq. m.

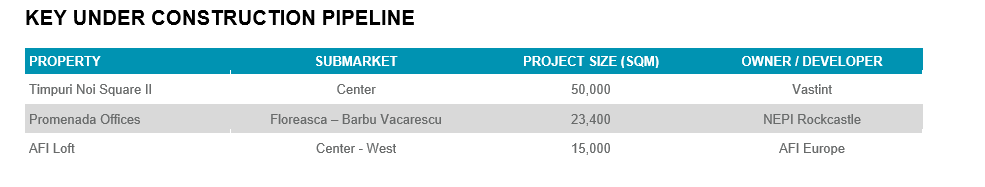

Mădălina Cojocaru, Partner Office Agency at Cushman & Wakefield Echinox: “After a record year in terms of leased office spaces in 2023, the Q1 data indicates a stabilization of demand on the market. A major concern is the limited number of new projects scheduled for delivery in the following 24 months, which will constrain the supply of high-quality office spaces. Only three projects are currently under construction in Bucharest, with a total area of 88,400 sq. m. Among these, AFI Loft (located in the Center – West area of the city) is the closest to completion, with the largest being the 2nd phase of the Timpuri Noi Square development (50,000 sq. m) which started construction in Q1.”

The net take-up had a low share (38%) in the total activity, in line with the trend observed during the past 3 years, as the major tenants preferred to consolidate their operations and renew their contracts in the existing premises. The vacancy rate has slightly decreased to a level of 14.4%, from 14.8% in Q1 2023 and from 14.7% at the end of last year. This indicator is expected to compress going forward, mostly on the account of the very limited short and medium – term pipeline.

BPO companies were the most active in terms of the leased areas, accounting for 36% of the total, representing entirely renegotiations of existing contracts. IT&C firms contributed to nearly 21% of the total volume, both through the renewal of existing premises and through new lease or relocations.

There has been no significant movement in terms of rental levels in Bucharest at the beginning of 2024, with the prime headline rent in the CBD area remaining at €22.00/ sq. m/ month.