Food Halls of Europe 2024/25 Edition

Bucharest, February 2022: Ten new retail projects have been completed in Romania in 2021, with a total GLA of around 100,000 square meters, withsix of them, totaling 70,000 square meters, being delivered in Q4 2021. The developers’ interest has shifted mostly towards tertiary cities with less than 150,000 inhabitants, and also towards retail parks, according to the Cushman & Wakefield Echinox real estate consulting company.

Therefore, developers focused mainly on cities with a low stock of modern retail spaces such as, Bârlad, Sfântu Gheorghe, Roșiorii de Vede, , Mediaș, Baia Mare or Focșani being among the beneficiaries of new retail projects in 2021. The only project delivered last year in Bucharest was the first phase of Fashion House Pallady of 8,500 square meters.

The most important deliveries, in terms of area, were Prahova Value Center (21,900 sq. m), Sepsi Value Center (16,300 sq. m) and Bârlad Value Center (16,300 sq. m), all developed by Prime Kapital – MAS Real Estate, one of the most active players in the market, while Scallier and Square 7 Properties – Mitiska have also expanded their retail portfolios in Romania during 2021.

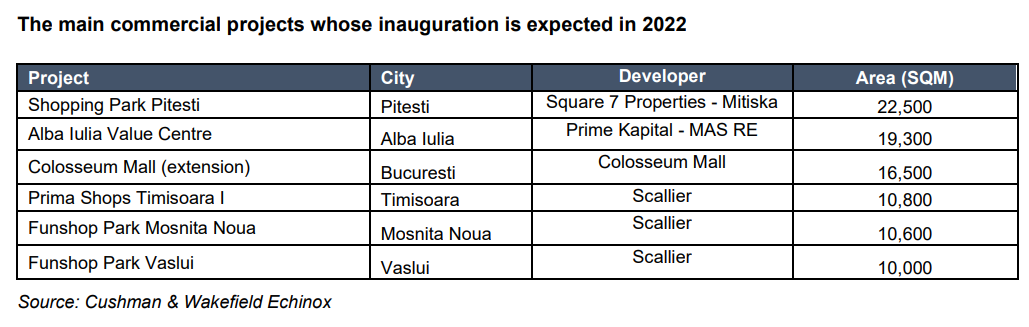

Retail parks continue to be the format targeted by developers in 2022, as more than 80% of the 100,000 square meters of new spaces due to be delivered this year are represented by such schemes.

The 16,500 sq. m extension of Colosseum Mall in Bucharest is the only shopping center that will be completed in 2022, thus becoming the first such scheme delivered in the Capital city after six years.

Scallier, Prime Kapital (in joint venture with MAS Real Estate), Square 7 Properties – Mitiska, and Iulius Group have the most consistent expansion plans on the Romanian retail market. It is also worth mentioning the interest of the Austrian group Supernova on this particular real estate segment, as they entered the Romanian retail market in 2020 through the acquisition of the Jupiter shopping center in Pitesti, while pursuing further investments in 2021, by acquiring a portfolio of six commercial properties operated by Cora, thus becoming a relevant player.

Bogdan Marcu, Partner, Retail Agency, Cushman & Wakefield Echinox: “The retail market remained highly active in 2021, amid the return of consumption, reflected in the evolution of retail sales, which had a growth rate in 2021 above the one recorded in 2019. This dynamic, supported by both food and non-food sales, can be noticed in the developers’ expansion plans in Romania, as currently, there are projects amounting to more than 300,000 square meters under different planning stages. Considering that the main targets for new projects in 2022 will once again be the cities with less than 150,000 inhabitants, and retail parks will be the dominant format, we might see a return of the focus towards large cities and shopping centers starting from 2023.”

Cushman & Wakefield Echinox, the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, has a team of over 80 professionals and collaborators offering a full range of real estate consultancy services to investors, developers, landlords and tenants. In the last two years, the company’s retail department has leased spaces with a total area of over 30,000 square meters in retail projects in both Bucharest and throughout the country. For more information, visit www.cwechinox.com

Cushman & Wakefield, one of the global leaders in commercial real estate services, with 50,000 employees in over 60 countries and € 7.8 billion in revenue, provides asset and investment management consulting services, capital markets, leasing, properties administration, tenant representation, valuation, research, design and project management services. For more information, visit www.cwechinox.com