Romania Investment Marketbeat H2 2025

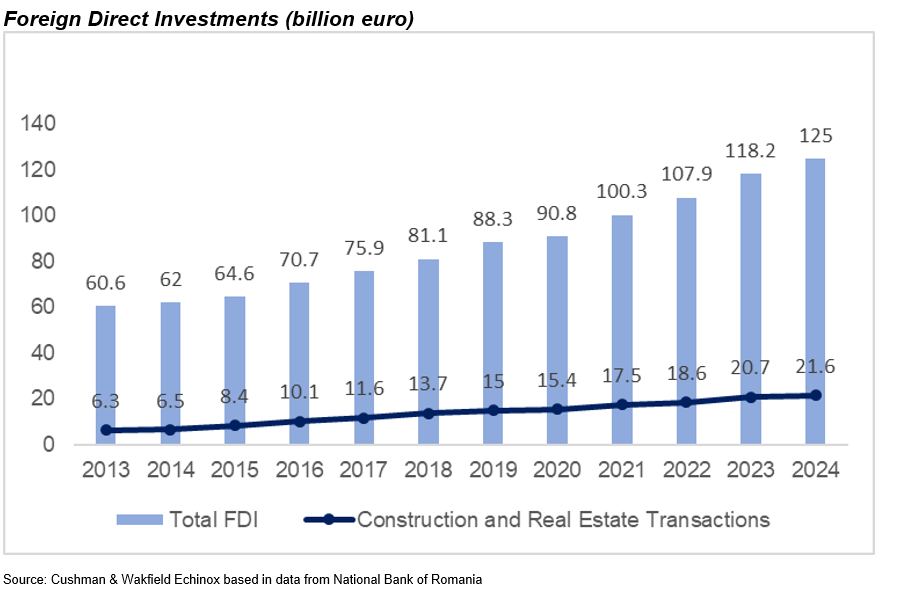

Bucharest, October 2025: Foreign direct investments (FDI) in the real estate and construction sector in Romania have more than tripled in absolute value during the 2014 – 2024 period (corresponding to an increase by €15.1 billion), up to a level of €21.6 billion. As a result, the share of this economic activity in the overall FDI stock rose from 10.6% in 2014 to 17.3% at the end of 2024, according to data from the National Bank of Romania analyzed by the Cushman & Wakefield Echinox real estate consultancy company.

Foreign capital inflows contributed to the expansion of modern real estate stock (office, retail and industrial & logistics) from approximately 5 million sq. m in 2014 to nearly 17 million sq. m at the end of 2024, with ~70% being owned by foreign investors.

The overall FDI stock reached €125 billion in 2024, the real estate and construction sector being among the top recipients of net foreign capital inflows last year, with an increase of €651 million compared with the previous year. This growth was mainly driven by a restart of intra-group lending and by a reduction of debt-type instruments, according to data from the Central Bank.

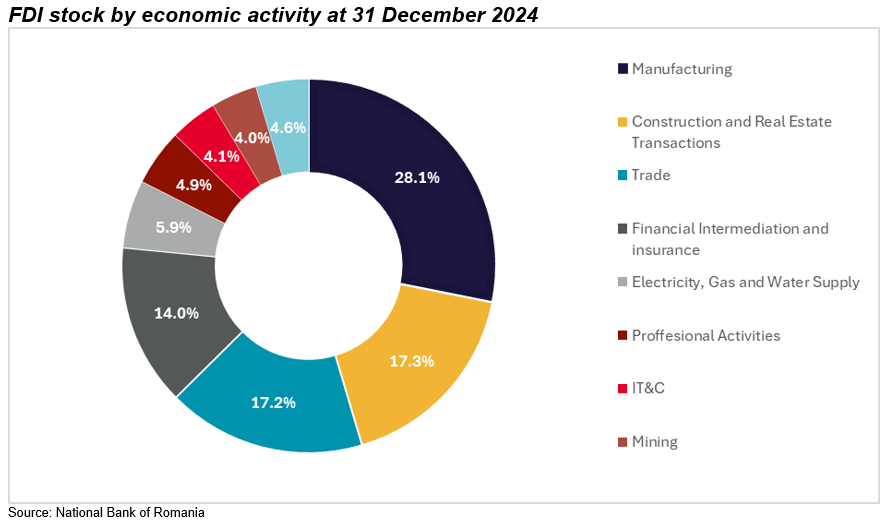

In terms of economic activities, 86.6% of the total net FDI stock is concentrated in four sectors: industry (37.1%), construction and real estate transactions (17.3%), trade (17.2%), and financial intermediation and insurance (14%).

Between 2014 and 2024, these four sectors experienced different growth rates. Industry saw a more modest increase of 54.4% (+€16.3 billion), while trade (+€14.8 billion) and construction and real estate (+€15.1 billion) have both more than tripled. Financial intermediation and insurance grew by 123% (+€9.6 billion).

These dynamics led to a decline in the industry’s share of total net FDI from 48.4% in 2014 to 37.1% in 2024 (-11.3 percentage points), while construction and real estate gained 6.7 percentage points (from 10.6% to 17.3%) and trade gained 6.4 percentage points (from 10.8% to 17.2%).

Moreover, the FDI position breakdown in greenfield enterprises in terms of the main economic activity placed construction and real estate transactions among the top three receivers, with a share of 18.2% of the total FDI in greenfield enterprises, after industry (26.9%) and trade (23%).

Bogdan Sergentu, Head of Valuation & Consulting, Cushman & Wakefield Echinox: “The real estate and construction sector continues to be one of the most stable and attractive industries for foreign investors, even in a context of economic and geopolitical uncertainties. The positive evolution of foreign capital flows and the high share of greenfield investments illustrate investor confidence in the Romanian market’s potential and in its ability to generate competitive long-term returns. The yields for prime assets in Romania are 1 – 2 percentage points above the reference values from most Central and Eastern Europe countries, thus representing a clear competitive advantage”.

Bogdan Sergentu, Head of Valuation & Consulting, Cushman & Wakefield Echinox: “The real estate and construction sector continues to be one of the most stable and attractive industries for foreign investors, even in a context of economic and geopolitical uncertainties. The positive evolution of foreign capital flows and the high share of greenfield investments illustrate investor confidence in the Romanian market’s potential and in its ability to generate competitive long-term returns. The yields for prime assets in Romania are 1 – 2 percentage points above the reference values from most Central and Eastern Europe countries, thus representing a clear competitive advantage”.

The total FDI flows in Romania were of €5.6 billion in 2024, down 17% from the previous year mainly as a result of the global uncertainties and the domestic vulnerabilities such as a modest economic growth, a deepening budget deficit, and a politically sensitive electoral context.

Foreign direct investment includes the paid-up capital and the reserves related to a non-resident investor holding at least 10% of the voting power or of the subscribed share capital of a resident enterprise, debt instruments between the investor or the group to which the investor belongs and the resident direct investment enterprise, as well as the reinvestment of earnings.