Romania Investment Marketbeat H2 2025

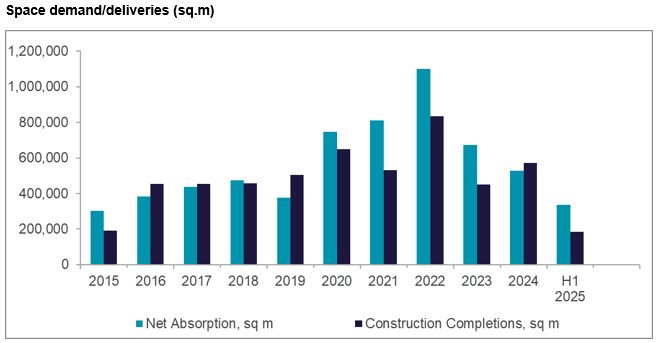

Bucharest, July 2025: Companies leased industrial & logistics spaces with a total area exceeding 500,000 sq. m in H1 2025, corresponding to a robust y-o-y increase of 25% compared with the same period of last year, according to the Romania Industrial Marketbeat Q2 2025 report by the Cushman & Wakefield Echinox real estate consultancy company. Moreover, the first half of 2025 ranks as the 3rd best-performing H1 in the last 12 years, with its leasing activity being 45% above the overall H1 average in the analyzed period.

The evolution of demand during the first six months creates the premises for the take-up volume to once again reach the 1 million sq. m threshold at the end of the year.

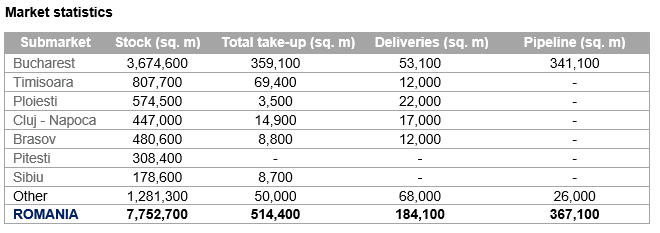

The net take-up (340,000 sq. m) had a share of 66% in the overall leasing volume throughout the semester and Bucharest remains the most important destination targeted by tenants, with 70% of the total spaces leased in H1 2025 (359,000 sq. m), followed by Timisoara with 13%, the 2nd largest industrial hub in the country.

Rodica Târcavu, Partner Industrial Agency Cushman & Wakefield Echinox: “The industrial & logistics market in Romania benefitted from a robust transactional activity in H1 2025, a positive evolution which gives us confidence and optimism that this segment will continue to develop in a solid and sustainable way, as it has been the case in the last few years. Market maturity and consolidation came in an economic context marked by an industrial production decline but supported by a strong overall consumption growth across the country. This dynamic can also be noticed in the structure of demand, largely generated by logistics and retail operators, while manufacturing companies had a smaller contribution, highlighting the market’s adaptability and the increasingly important role of the distribution segment in regional supply chains.”

Rodica Târcavu, Partner Industrial Agency Cushman & Wakefield Echinox: “The industrial & logistics market in Romania benefitted from a robust transactional activity in H1 2025, a positive evolution which gives us confidence and optimism that this segment will continue to develop in a solid and sustainable way, as it has been the case in the last few years. Market maturity and consolidation came in an economic context marked by an industrial production decline but supported by a strong overall consumption growth across the country. This dynamic can also be noticed in the structure of demand, largely generated by logistics and retail operators, while manufacturing companies had a smaller contribution, highlighting the market’s adaptability and the increasingly important role of the distribution segment in regional supply chains.”

The two largest contracts concluded in Q2 were exclusively represented by renegotiations, one of 16,000 sq. m signed by Kyocera in CTPark Timisoara Ghiroda, followed by Sarantis (11,000 sq. m in WDP Park Dragomiresti).

Logistics and distribution operators had the largest share in the transacted volume (30% and 160,000 sq. m respectively), while 133,000 sq. m were leased by retail, e-commerce, and FMCG companies (26%), as the manufacturing and automotive industry sector has a share of approximately 5-6% (27,000 sq. m).

The modern stock of industrial & logistics spaces in Romania reached 7.75 million sq. m at the end of Q2, as developers completed new projects with a total leasable area of 184,100 sq. m in H1, a 77% growth compared with the same period last year.

Moreover, the current under-construction pipeline is of approximately 370,000 sq. m across the country.

The nationwide vacancy rate increased to a level of 5.8%, but a downward movement is expected in the coming quarters due to the relatively low number of speculative projects under-construction.

The prime headline rent in Bucharest remained flat, but a series of spikes were recorded in other major hubs such as Timisoara or Brasov, with the asking rents in top projects in Romania ranging between €4.30 – 4.70/ sq. m/ month in Q2. These levels could see minor upward adjustments by the end of the year, against a backdrop of increasing construction costs and land acquisition prices.