Romania Investment Marketbeat H2 2025

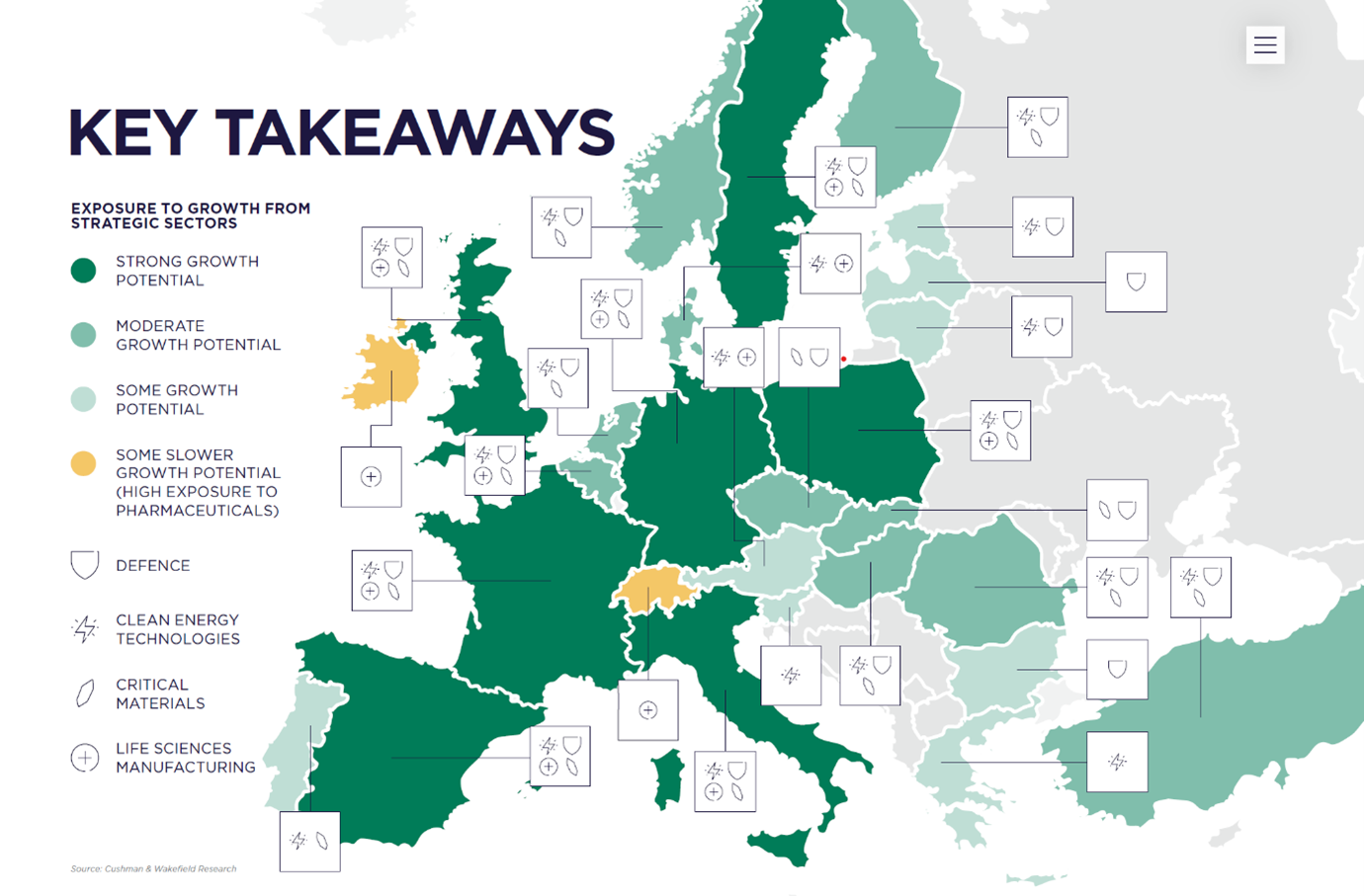

Bucharest, October 2025: Demand for industrial and logistics spaces in Europe, including Romania, is set to increase significantly in the coming years, driven by strategic investments in defence, green energy, critical materials for the technology sector, as well as life sciences, according to the report “Opportunities for Industrial Real Estate in Europe – Strategic Sector Signals”, released by Cushman & Wakefield.

The report highlights the major transformations shaping the industrial property market amid new security, sustainability and supply chain resilience policies. In this context, Romania is positioning itself as a key player in Central and Eastern Europe, benefiting from significant investments and accelerated growth in demand for industrial and logistics spaces.

Andrei Brînzea, Partner Business Development Cushman & Wakefield Echinox: “In a European context marked by geopolitical and economic shifts, Romania could consolidate its strategic position for these industries. Investments in infrastructure, favourable public policies and partnerships with global leaders will accelerate this transformation, with a positive impact on the national economy and the country’s standing on the industrial map of Europe. On the other hand, understanding the logistical and industrial needs of companies in these sectors can open opportunities for both tenants and investors.”

Andrei Brînzea, Partner Business Development Cushman & Wakefield Echinox: “In a European context marked by geopolitical and economic shifts, Romania could consolidate its strategic position for these industries. Investments in infrastructure, favourable public policies and partnerships with global leaders will accelerate this transformation, with a positive impact on the national economy and the country’s standing on the industrial map of Europe. On the other hand, understanding the logistical and industrial needs of companies in these sectors can open opportunities for both tenants and investors.”

The report includes Romania among the countries with grow potential in defence, the green energy sector, and investments in the production of critical materials.

Regarding the defence industry, investments in military infrastructure and logistics are on the rise, with Romania and Poland considered major military hubs on the eastern border of the European Union. In the last 18 months, several strategic partnerships have been announced between the Romanian state and various defence manufacturers, partnerships that will generate new Romanian or foreign private investments.

In the field of green energy, the EU has set the goal that by 2030, at least 42.5% of energy consumption will come from renewable sources, and the Net-Zero Industry Act (NZIA) requires that by 2030, 40% of the annual production capacity for net-zero technologies will be achieved within the EU.

Romania, with access to a skilled workforce and competitive costs, is becoming a preferred destination for developers and investors in the production of net-zero and renewable energy technologies. In this sense, the pilot project for small modular reactors (SMR), which will be hosted by Romania, is worth mentioning.

In terms of critical natural resources, Romania can attract investments in extraction, processing and recycling facilities, as well as in logistics centres dedicated to these types of raw materials.

According to the report, the EU’s demand for rare metals will increase six times by 2030 and seven times by 2050. For lithium (mainly used in the production of rechargeable batteries), estimated growth is twelve times by 2030 and twenty-one times by 2050.

Furthermore, the Critical Raw Materials Act (CRMA) sets the target that by 2030, at least 10% of the annual consumption of strategic raw materials will be extracted in the EU, 40% will be processed, and 25% will come from recycling.

For the industrial property market, the implications are clear: demand for specialised industrial and logistics spaces is set to accelerate, especially in established centres and strategic hubs.

However, developers must understand tenants’ requirements, especially when they are seeking to expand their activities. Given that these are highly dynamic industries, developers need to be prepared to provide suitable real estate solutions and ensuring a land reserve can help capitalise on these opportunities.