Food Halls of Europe 2024/25 Edition

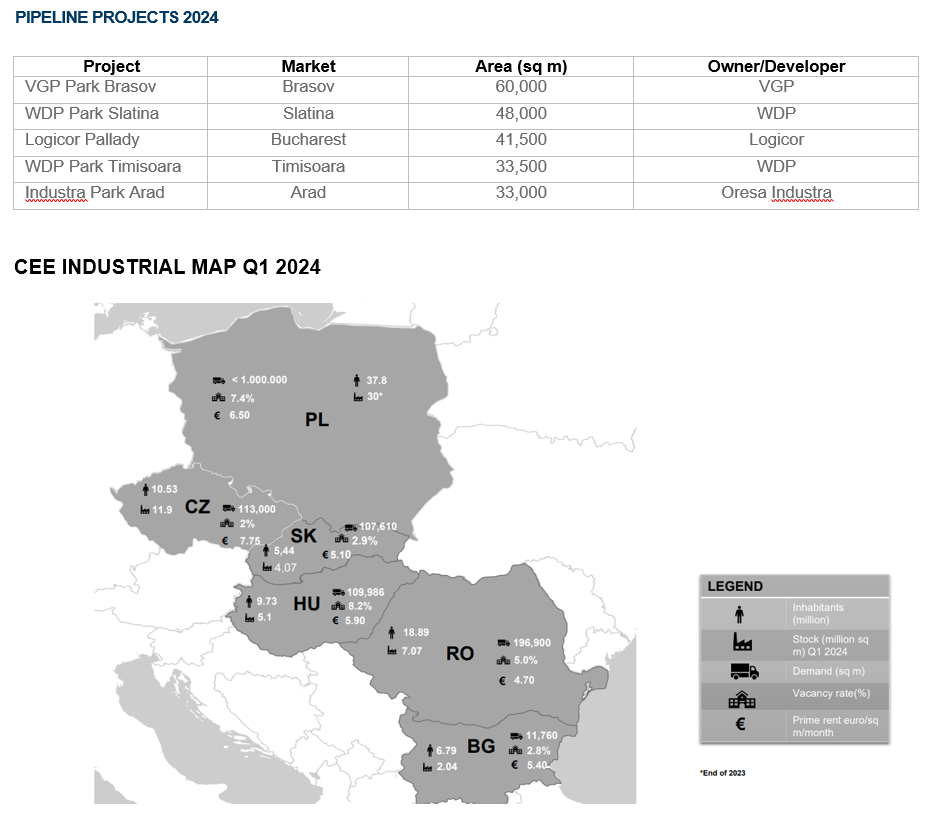

Bucharest, May 2024: Companies leased approximately 200,000 sq. m of industrial and logistics spaces in Q1, the demand being primarily generated by manufacturing companies, FMCG and logistics operators, according to data from the Cushman & Wakefield Echinox real estate consultancy company. Romania ranked second regionally in terms of the Q1 demand, after Poland, the uncontested leader in the Central and Eastern Europe, while surpassing Czechia, Slovakia and Hungary.

160,000 sq. m were transacted in Czechia, while 109,000 and 107,000 sq. m of industrial & logistics spaces were leased in Hungary and Slovakia respectively.

The activity of manufacturing companies on the Romanian industrial leasing market was noteworthy at the beginning of the year in terms of the share of spaces contracted in the total transactional volume (17%), while overtaking logistics operators (10%) and FMCG companies (13%) for the first time.

The largest transaction closed in Q1 2024 was related to a 19,000 sq. m sale & leaseback of Tenneco’s spaces in Ploiesti to WDP, followed by a 11,000 sq. m pre – lease by Maravet within WDP Park Baia Mare, a transaction brokered by Cushman & Wakefield Echinox, and by the new lease signed by Drim Daniel Distributie in a 10,000 sq. m warehouse space in MLP Bucharest West.

Stefan Surcel, Head of Industrial Agency Cushman & Wakefield Echinox: “Manufacturing companies are becoming increasingly relevant on the industrial and logistics leasing market, partly due to the nearshoring phenomenon, but also through relocations from Western Europe or even from other countries in the CEE. These companies usually operate in their own spaces, but they also require greater flexibility due to the ever changing consumer habits, a flexibility which can be achieved by renting other premises. We believe this trend will intensify in the coming period while the ongoing infrastructure projects will open up new areas for investments in industrial projects.”

Demand was mainly concentrated in Romania’s major logistics hubs, namely around Bucharest (50% of the total volume), Ploiesti (10%) and Timisoara (6%), with companies also showing interest towards Iasi, Craiova, Arad and Oradea.

In terms of the new supply, the first quarter recorded a slowdown of investments, as developers adopted a more cautious approach amid the present economic uncertainties and the decreasing number of speculatively developed projects. Therefore, only 50,000 sq. m of new spaces were delivered in Q1 (compared with 100,000 sq. m in the same period of 2023). The stock of industrial and logistics spaces reached 7.07 million sq. m, with vacancy rates of 6.1% in Bucharest and 5.0% at regional level.

Developers currently have under construction projects with a total area of 500,000 sq. m in various cities across the country. Bucharest, Timisoara and Brasov are the main destinations for developers, with approximately 50% of the upcoming projects located in these logistics hubs, while Slatina, Arad and Sibiu will also benefit from significant new spaces on the short term.