Construction Insights 2026

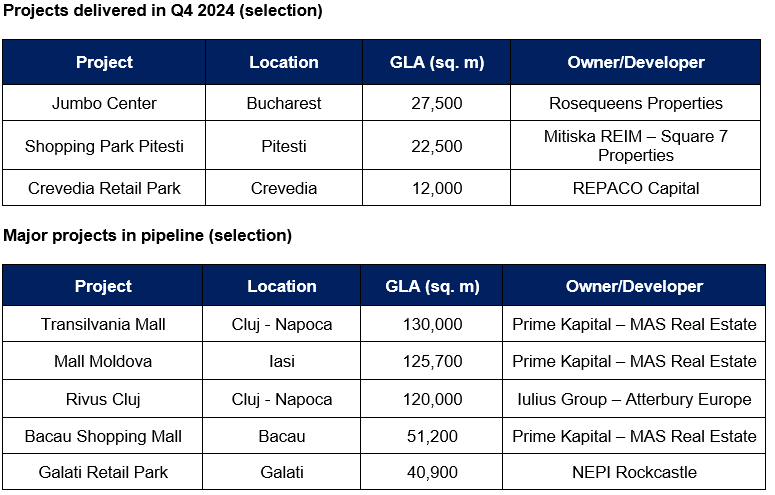

Bucharest, January 2025: The modern retail stock in Romania reached 4.62 million sq. m, with projects cumulating around 180,000 sq. m GLA being completed in 2024, reflecting a 15% decrease when compared with 2023, while still being one of the best years in the past decade when it comes to new completions, according to data from the Cushman & Wakefield Echinox real estate consultancy company.

Developers completed 14 retail projects in 2024, representing both new schemes and extentions of existing projects, with retail parks having a 64% share in the delivered areas, the rest consisting of shopping centers.

Pitesti, Ploiesti, Giurgiu, Crevedia, Hunedoara, Bistrita, Sinaia, Ramnicu Valcea are among the cities which benefited from such investments in 2024, while the most important project completed last year in Bucharest was Jumbo Center (25,700 sq. m), which represented a complete refurbishment of the former Liberty Center.

Arges Mall in Pitesti, an 51,400 sq. m GLA project owned by Prime Kapital – MAS Real Estate, was the largest retail scheme delivered in 2024. Other projects finalized during the year were Shopping Park Pitesti (22,500 sq. m developed by Mitiska REIM – Square 7 Properties) and Aurora Retail Park Giurgiu of 13,000 sq. m owned by Cometex.

The potential for further growth is reflected in the current developers’ plans which exceed 700,000 sq. m GLA (under construction or planned projects) and which are due to be completed by 2028/ 2029, with Cluj Napoca, Iasi, Bacau, Galati and Bucharest being some of the targeted locations for new investments.

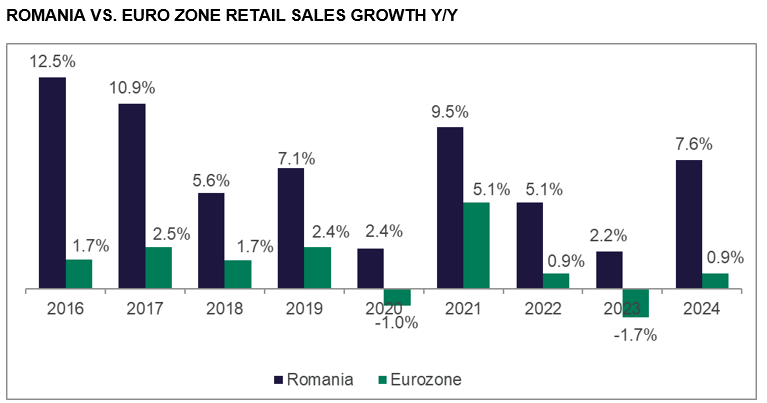

Dana Radoveneanu, Head of Retail Agency Cushman & Wakefield Echinox: ”The Romanian retail market remains attractive for both retailers and developers, despite the local and European macroeconomic pressures. The recent deliveries of modern retail projects and the robust long-term pipeline underscore the market’s potential. Whether we are referring to smaller retail parks in emerging cities or to large urban regeneration projects, there is a clear upward trajectory of this market segment. Favored by one of the lowest densities of modern retail spaces, but also by impressive retail sales’ growth, Romania continues to strengthen its position on the European retail market.”

Dana Radoveneanu, Head of Retail Agency Cushman & Wakefield Echinox: ”The Romanian retail market remains attractive for both retailers and developers, despite the local and European macroeconomic pressures. The recent deliveries of modern retail projects and the robust long-term pipeline underscore the market’s potential. Whether we are referring to smaller retail parks in emerging cities or to large urban regeneration projects, there is a clear upward trajectory of this market segment. Favored by one of the lowest densities of modern retail spaces, but also by impressive retail sales’ growth, Romania continues to strengthen its position on the European retail market.”

The prime shopping center rent in Bucharest stabilized in Q4 2024 to a level of €90 /sq. m /month, while the corresponding figures in secondary cities – Cluj-Napoca, Timisoara, Iasi and Constanta – remained flat, ranging between €50-65 /sq. m/month, the same situation being observed in tertiary locations, where levels between €30-35 /sq. m/month were recorded.