Construction Insights 2026

Bucharest, February: The office development activity in Bucharest accelerated over the past year, with the volume of projects currently under construction exceeding 200,000 sq. m of gross leasable area, the highest level since 2021. At least eight new office buildings are expected to be delivered by the end of 2028, according to the Bucharest Office Marketbeat Q4 2025, published by the Cushman & Wakefield Echinox real estate consultancy company.

This renewed development momentum follows two years of historically low delivery levels, totaling just 15,000 sq. m, corresponding to a single building. Moreover, no new office projects were completed in Bucharest in 2025, a first in the history of the city’s modern office era.

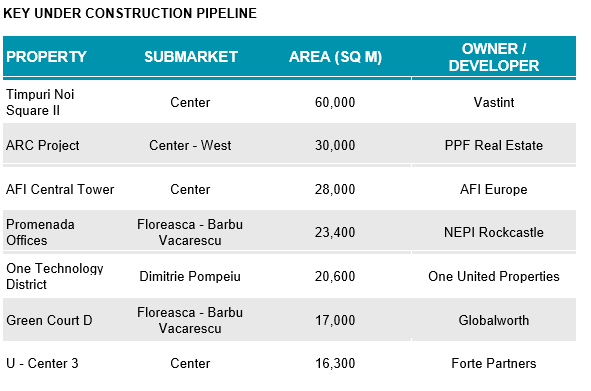

The largest project under construction is a new phase of Timpuri Noi Square, developed by Vastint in the Center submarket.

Other developments underway include: ARC Project in the Grozavesti – Politehnica area (PPF Real Estate) – 30,000 sq. m, Promenada Offices (NEPI Rockcastle), part of the Promenada Mall extension in the Floreasca – Barbu Vacarescu submarket – 23,400 sq. m, One Technology District in Dimitrie Pompeiu (One United Properties) – 20,600 sq. m, AFI Central Tower (AFI Europe), a redevelopment of the former Bucharest Financial Plaza building – 28,000 sq. m and U – Center 3 (Forte Partners) – 16,300 sq. m

Moreover, the latest announced project is Green Court D (17,000 sq. m), developed by Globalworth, the largest owner of office spaces on the Romanian office market.

The limited deliveries of the past two years, combined with increasing net demand (excluding renegotiations), brought the vacancy rate down to 12.1% (vs 14.2% in Q4 2024 and the lowest level since Q3 2020), while also pushing rents up in submarkets with constrained availability.

A gross take-up volume of 85,000 sq. m was registered in Q4 in Bucharest, while the total for the year reached 282,200 sq. m, corresponding to a 23% decrease compared with 2024. Net take-up accounted for 53% of total demand, up from 44% in 2024.

The CBD submarket recorded a 5% rental growth in prime buildings, up to a level between €21.00 – 22.00/ sq. m/ month (higher values were reported in smaller – sized boutique projects), with the benchmarks from other areas varying between €15.00 – 18.50/ sq. m/ month and €9.00 – 13.50/ sq. m/ month in central/ semi – central and peripheral locations in existing buildings, while the under – construction ones reflect asking rents generally ranging between €18.00 – 22.00/ sq. m/ month, taking into account their upscale technical specifications and higher construction costs.

Bucharest’s modern office stock stands at 3.43 million sq. m, having a 15% share among the Central and Eastern Europe (CEE) capital cities. The regional market is led by Warsaw (28%), followed by Budapest (20%), Prague (18%), Sofia (11%), and Bratislava (8%).

Mădălina Cojocaru, Partner, Office Agency, Cushman & Wakefield Echinox: “The tenants’ selection criteria currently extend well beyond the traditional parameters of space efficiency. Access to public transportation, proximity to residential areas, and a well‑developed network of services have become critical decision‑making factors. Equally important is the community which forms around a building, as well as the willingness of property managers to implement events and initiatives which activate and enrich the common areas. The office has evolved from a purely operational location into an ecosystem designed to support collaboration, organizational culture, and the everyday employee experience. Against this backdrop, the renewed activity in office development provides companies with the opportunity to secure spaces that not only meet functional requirements but also enhance their positioning and attractiveness as employers.”

Mădălina Cojocaru, Partner, Office Agency, Cushman & Wakefield Echinox: “The tenants’ selection criteria currently extend well beyond the traditional parameters of space efficiency. Access to public transportation, proximity to residential areas, and a well‑developed network of services have become critical decision‑making factors. Equally important is the community which forms around a building, as well as the willingness of property managers to implement events and initiatives which activate and enrich the common areas. The office has evolved from a purely operational location into an ecosystem designed to support collaboration, organizational culture, and the everyday employee experience. Against this backdrop, the renewed activity in office development provides companies with the opportunity to secure spaces that not only meet functional requirements but also enhance their positioning and attractiveness as employers.”