WAYPOINT 2025

Bucharest, January 2022: The volume invested in real estate assets in Romania, Poland and Slovakia increased in 2021, while the Czech and Hungarian markets witnessed a downturn when compared with 2020, according to data from the Cushman & Wakefield Echinox real estate consulting company.

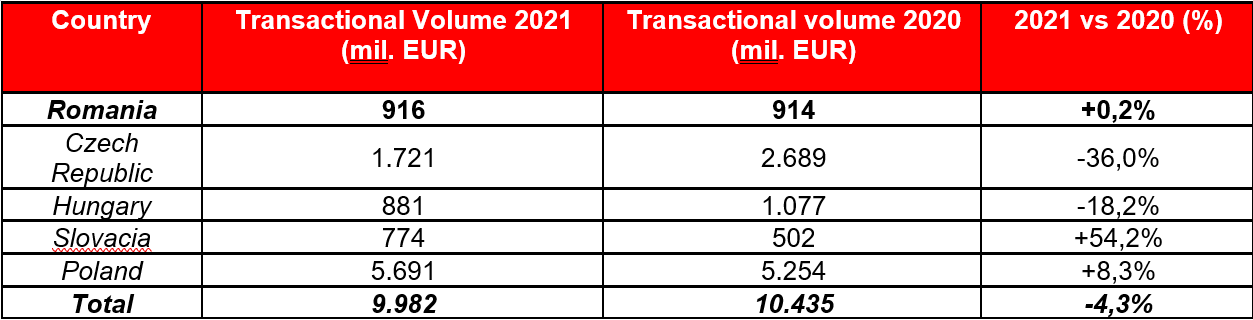

At regional level, the total transacted volume reached 9.98 billion euros, a 4.3% decrease compared with the previous year. The Polish market registred a growth of 8.3%, while the transacted volume in Slovakia was 54.2% higher in 2021 than in the previous year. On the other hand, Czech Republic registered a 36% drop in transactions pertaining to income-producing assets, while the volume in Hungary declined by 18.2%.

In Romania, 54 transactions with real estate assets were completed last year, twice more such transactions in comparison with 2020, as the total investment volume reaching 916 million euros, up 0.2%, according to the Romania Investment Marketbeat, launched by the Cushman & Wakefield Echinox real estate consultancy company.

After a first semester in which the investment volume was below the level registered in the same period of 2020, the market has strongly recovered in H2 2021, with transactions totaling 618 million euros being recorded, an increase of more than 100% when compared with the first six months of the year.

In terms of asset class, most transactions concerned logistics and industrial premises – around 40% of the total (21), followed by retail properties (13). Despite a smaller number of assets transacted, the 8 office buildings that changed their owners in 2021 had a 44% market share out of the total volume (402 million euros). followed by the industrial segment (30% share) and retail (20%).

Cristi Moga, Head of Capital Markets Cushman & Wakefield Echinox: “The investor’s interest in real estate assets remained at a high level in 2021 amid a relative re-balancing of the relationship between landlords and tenants, an aspect which is meant to ensure a stable financial flow for investors. In a generally positive climate, we expect a higher number of landlords to re-evaluate the opportunity to commence a selling process, which would increase the market liquidity. A part of the market with high potential concerns the sale & lease-back transactions, as the owners of various businesses will benefit from such deals as they will be able to finance their core businesses by disposing their real estate portfolios. In 2022, we can expect new record deals, which could contribute to exceeding the 1 billion euros transactional volume threshold.”

Cristi Moga, Head of Capital Markets Cushman & Wakefield Echinox: “The investor’s interest in real estate assets remained at a high level in 2021 amid a relative re-balancing of the relationship between landlords and tenants, an aspect which is meant to ensure a stable financial flow for investors. In a generally positive climate, we expect a higher number of landlords to re-evaluate the opportunity to commence a selling process, which would increase the market liquidity. A part of the market with high potential concerns the sale & lease-back transactions, as the owners of various businesses will benefit from such deals as they will be able to finance their core businesses by disposing their real estate portfolios. In 2022, we can expect new record deals, which could contribute to exceeding the 1 billion euros transactional volume threshold.”

Moreover, it should be noted that the top five transactions comprise all the three major asset classes – office, industrial and retail.

The largest transactions in terms of volume pertained to Louis Delhaize’s (Cora) sale and leaseback of its six commercial galleries in Romania to Supernova and Atenor Group’s disposal of the Hermes Business Campus (75,000 sq. m GLA) office project in Bucharest to Adventum Group, this transaction marking the latter’s entrance on the Romanian real estate market.

Moreover, CTP (the largest owner of industrial and logistics spaces in the country) went forward in terms of strengthening its position by completing four transactions during the year, totaling €170 million.

The prime yields recorded a significant compression of around 50-75 basis points in H2 2021, as a further decrease is expected in 2022. However, the spread between the local market and the more mature countries in CEE, such as the Czech Republic, Poland or Hungary, is still relatively high (100-300 basis points’ range), which could accelerate the compression.

Cushman & Wakefield Echinox is a top real estate consulting company on the local market and the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, with a team of over 80 professionals and collaborators offering a full range of services to investors, developers, landlords and tenants. For more information, visit www.cwechinox.com

Cushman & Wakefield, one of the global leaders in commercial real estate services, with 50,000 employees in over 60 countries and € 7.8 billion in revenue, provides asset and investment management consulting services, capital markets, leasing, properties administration, tenant representation, project management, design and evaluation services. For more information, visit www.cwechinox.com