WAYPOINT 2025

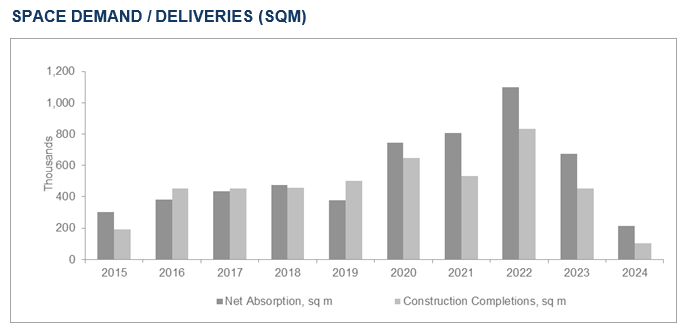

Bucharest, August 2024: Companies leased 410,500 sq. m of industrial & logistics spaces in H1, a total which reflects a 25% drop when compared with H1 2023. However, the new demand had a share of 52% in the overall leasing volume in the same period (213,500 sq. m), more than double vs. the new supply, according to data from the Cushman & Wakefield Echinox real estate consultancy company.

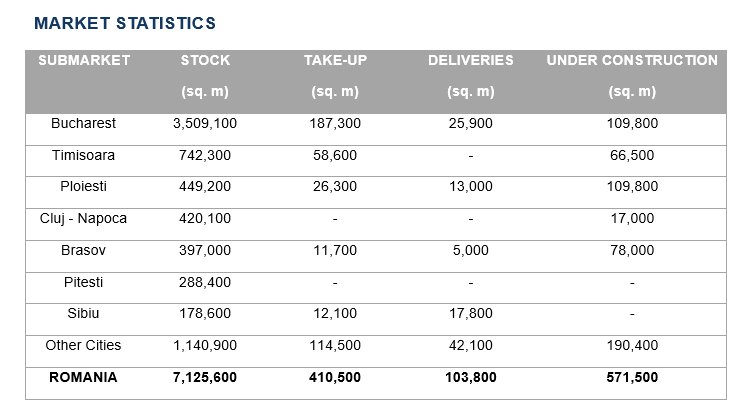

Bucharest attracted 46% of the total take-up in H1 2024 (186,300 sq. m), followed by Arad (15%, 62,700 sq. m) and Timisoara, the second-largest industrial hub in Romania (14%, 58,600 sq. m). Ploiesti, Oradea and Sibiu were other important locations in terms of industrial & logistics activity.

Rodica Tarcavu, Partner Industrial Agency Cushman & Wakefield Echinox: ”The macroeconomic indicators were much better in Q2, as inflation has been contracting in Romania for more than 6 months, reaching an average level of 6.8% during the last quarter. The National Bank of Romania has reacted by decreasing the monetary policy rate in June by 25 bp to 6.75%, the first such movement in 18 months. Moreover, the economy was highly resilient in H1, with GDP growth rates of 1.8% and 2.1% being recorded in Q1 and Q2 respectively. An overall annual growth of 2.7% is anticipated for 2024, a notable evolution given the still volatile macroeconomic and geopolitical context. All these variables create the context for another solid year for the industrial & logistics market, both in terms of supply and demand”.

Rodica Tarcavu, Partner Industrial Agency Cushman & Wakefield Echinox: ”The macroeconomic indicators were much better in Q2, as inflation has been contracting in Romania for more than 6 months, reaching an average level of 6.8% during the last quarter. The National Bank of Romania has reacted by decreasing the monetary policy rate in June by 25 bp to 6.75%, the first such movement in 18 months. Moreover, the economy was highly resilient in H1, with GDP growth rates of 1.8% and 2.1% being recorded in Q1 and Q2 respectively. An overall annual growth of 2.7% is anticipated for 2024, a notable evolution given the still volatile macroeconomic and geopolitical context. All these variables create the context for another solid year for the industrial & logistics market, both in terms of supply and demand”.

The largest transaction closed in Q2 2024 was related to a 20,900 sq. m pre – lease by VAT Group within VGP Park Arad, followed by a 20,000 sq. m pre – lease by Deichmann in ELI Park 3 Bucharest.

Production and manufacturing companies were the most active players on the market throughout H1, with almost 100,000 sq. m of warehouse spaces being leased by those tenants, followed by logistics and distribution operators (63,000 sq. m), retail, e-commerce and FMCG companies with 48,000 sq. m, automotive sector (24,000 sq. m) and pharma (17,800 sq. m).

The total modern stock of industrial & logistics spaces reached almost 7.13 million sq. m at the end of Q2, as developers completed new projects with a total leasable area of ~104,000 sq. m across the country in H1 2024, among which around 60,000 sq. m were delivered in Q2.

The total development activity in H1 2024 slowed down when compared with H1 2023, when it accounted for 202,000 sq. m, while the estimated new supply for the next 18 months is at around 571,000 sq. m. As such, the national stock could exceed 7.5 million sq. m by the end of the year.

Bucharest – Ilfov and Ploiesti have the largest share in the overall pipeline volume (110,000 sq. m each), followed by Brasov (78,000 sq. m) and Timisoara (66,000 sq. m).

The vacancy rate at national level has slightly decreased to 4.8%, while a further drop is expected by the end of 2024, as a result of the limited developments on a speculative basis.

The prime headline rents in Bucharest and in the main industrial & logistics destinations in Romania remained flat at levels ranging between €4.30 – €4.70/ sq. m/ month in Q2 2024. No significant changes are expected in the coming period concerning the rental levels for existing projects, especially those which have a higher degree of vacancy, while an upward trend is predicted for the new developments, due to the surging construction costs and land acquisition prices.