WAYPOINT 2025

Bucharest, April 2024: Developers finalized the construction of 83,000 sq. m of new office projects in the major regional cities (Cluj – Napoca, Timisoara, Iasi and Brasov) in 2023, as the modern office stock exceeded the 1 million sq. m threshold, representing around 30% of the corresponding total in Bucharest. Iasi is the only city which benefited from the delivery of office projects throughout 2023, as it overtook Timisoara and thus became the second – largest regional hub outside Bucharest, after Cluj-Napoca, according to the Cushman & Wakefield Echinox Office Market Regional Cities report.

The stock of modern office spaces in these cities reached 1.082 million sq. m. Cluj – Napoca remains the largest regional office hub, with 340,400 sq. m of such spaces at the end of 2023 (31.5% of the total), followed by Iasi, where the stock expanded after the delivery of Palas Campus (60,000 sq. m) and the 1st phase of Silk District (23,000 sq. m) to 296,200 sq. m (27.4% of the total), while in Timisoara the stock stood at 293,500 sq. m (27.1%) and in Brasov at 152,200 sq. m (14%).

The office pipeline in the analyzed cities is very low compared with the deliveries registered in 2023, as only 2 projects with a total area of 26,000 sq. m may be completed by the end of 2024 / beginning of 2025, namely Coresi Business Campus U1 in Brasov and Paltim in Timisoara.

However, developers have also announced plans to start the construction of further 170,000 sq. m of new office spaces in the major regional cities in the next 5 years, out of which 75,000 sq. m are located in Cluj – Napoca, 81,000 sq. m in Iasi and 10,000 sq. m in Brasov.

Among the main office projects under construction or under different planning stages, we can mention the following: in Iasi – Silk District phase II, developed by Prime Kapital – MAS RE; in Brasov – AFI Europe intends to develop the 2nd phase of AFI Park and NHood also announced a new building within the Coresi Business Campus. The most important projects expected in Cluj – Napoca relate to the Prime Kapital – MAS RE and Iulius Group mixed – use developments which are scheduled to be built on the former Cesarom and Carbochim industrial platforms.

Vlad Saftoiu, Head of Research Cushman & Wakefield Echinox: “The major regional centers boast a combined enrollment of around 190,000 students (more than in Bucharest) and a workforce of approximately 550,000 employees (representing more than 50% of the level recorded in Bucharest), while the office stock in these cities is less than a third of the corresponding total from the capital city. Therefore, if we adjust these figures to the economic context of the analyzed cities, we believe that Cluj – Napoca, Iasi, Timisoara and Brasov have the capacity to attract new companies which will generate demand for office spaces and we estimate that another ~400,000 sq. m of new projects could be absorbed by the cities in question in the long term.”

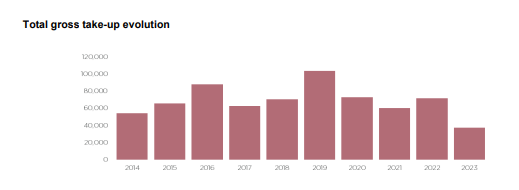

The main driver of the leasing activity has once again been the IT&C sector, which had a share of more than 60% in the 2023 take-up, which reached 37,400 sq. m. Unlike the Bucharest office market, which registered a record level of demand in 2023, the transacted area in the main regional cities was around 50% lower y-o-y according to the available data in the market. Cluj – Napoca and Iasi were the most preferred destinations by tenants, with those cities having a combined share of approximately 60% in the total demand.

Cluj – Napoca has the lowest vacancy rate (6.2%) outside Bucharest, while 10.7% and 11.8% of the Timisoara and Brasov office stocks are unoccupied. Moreover, a higher vacancy rate of 20.4% is recorded in Iasi, mostly in B class buildings.

The Cushman & Wakefield Echinox office agency is the market leader in Romania, closing transactions totaling 113,000 sq. m in 2023. Moreover, the office team has overseen leasing deals of more than 250,000 sq. m during the past 3 years in Bucharest and in the main regional cities.

Cushman & Wakefield Echinox is a leading real estate company on the local market and the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, with a team of over 80 professionals and collaborators offering a full range of services to investors, developers, owners and tenants.

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in nearly 400 offices and 60 countries. In 2023, the firm reported revenue of $9.5 billion across its core services of property, facilities and project management, leasing, capital markets, and valuation and other services. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity and Inclusion (DEI), sustainability and more. For additional information, visit www.cushmanwakefield.com.