Romania Investment Marketbeat H2 2025

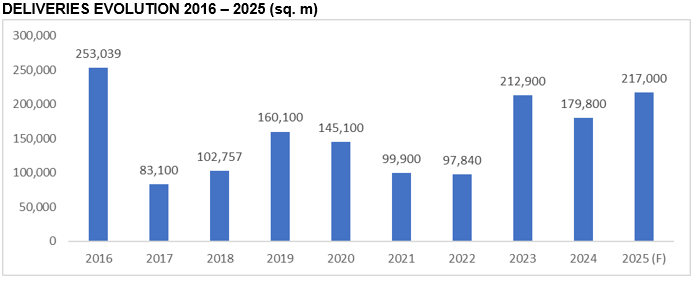

Bucharest, October 2025: The new supply of retail projects in the first 9 months of the year exceeded the level recorded in the entire 2024, as 2025 is shaping up to be the second most prolific year over the past decade in terms of new retail space deliveries, according to the Romania Retail Marketbeat Q3 2025 report released by the Cushman & Wakefield Echinox real estate consultancy company.

Developers completed 186,000 sq. m of new retail spaces in the Q1 – Q3 period, compared with 180,000 sq. m delivered across the entire 2024. Moreover, an extra 30,000 sq. m are due to be delivered by the end of the year, resulting in a total annual supply of approximately 217,000 sq. m.

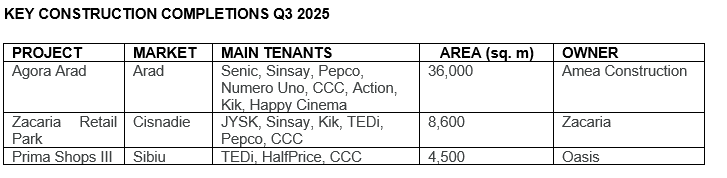

In Q3 2025, 3 new projects were completed, all of them located in the broad Transilvania region (Arad, Cisnadie and Sibiu).

Agora Arad (formerly Galleria Arad) is the largest project delivered in Q3 (36,000 sq. m) and it opened following a significant process of refurbishment and market repositioning. The Cushman & Wakefield Echinox retail team provided strategic consultancy during the leasing process, attracting a wide range of retailers, including the first Senic supermarket in Romania.

Zacaria Retail Park Cisnadie (8,600 sq. m) and the 3rd phase of Prima Shops Sibiu (4,500 sq. m) were also delivered in Q3 2025.

Dana Radoveneanu, Head of Retail Agency Cushman & Wakefield Echinox: “The retail market performance throughout 2025 reflects resilience and a significant potential of this segment, even in a challenging economic context. The fact that in the first 9 months alone we have already surpassed the total 2024 new supply shows the confidence developers and retailers have in the local market. We are pleased to notice important investments in cities across Transilvania and an ever-increasing diversification of the offer for consumers. Although the relatively complicated macroeconomic context, characterized by high inflation and a series of fiscal measures adopted to tackle the rising budget deficit, the positive evolution of the retail sector confirms that Romanians remain eager for new shopping and social experiences, and developers are responding with modern projects adapted to the needs of local communities.”

Dana Radoveneanu, Head of Retail Agency Cushman & Wakefield Echinox: “The retail market performance throughout 2025 reflects resilience and a significant potential of this segment, even in a challenging economic context. The fact that in the first 9 months alone we have already surpassed the total 2024 new supply shows the confidence developers and retailers have in the local market. We are pleased to notice important investments in cities across Transilvania and an ever-increasing diversification of the offer for consumers. Although the relatively complicated macroeconomic context, characterized by high inflation and a series of fiscal measures adopted to tackle the rising budget deficit, the positive evolution of the retail sector confirms that Romanians remain eager for new shopping and social experiences, and developers are responding with modern projects adapted to the needs of local communities.”

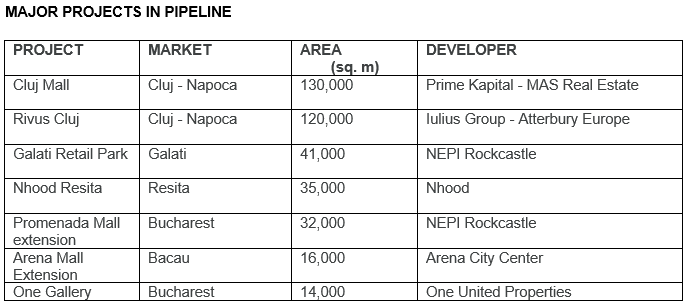

The modern retail stock in Romania is of 4.80 million sq. m (a density of 252 sq. m/ 1,000 inhabitants), while projects exceeding 700,000 sq. m GLA are currently in different construction and planning stages, being due for delivery by the end of this decade.

There have been no significant rental movements pertaining to the prime headline rents in dominant shopping center and high street locations in Romania during Q3, as flagship units on Calea Victoriei in Bucharest are still quoted at around € 70 / sq. m/ month, while major shopping centers in Bucharest and in the main secondary locations can achieve rental revenues ranging between € 50 – 90 / sq. m/ month for 100 – 200 sq. m spaces located at the ground floor