Construction Insights 2026

Bucharest, February 2024: Real estate investment transactions amounting to more than €600 million are currently in advanced stages of negotiation, as the volume registered throughout 2023 could be matched in the first half of this year, according to data from the Cushman & Wakefield Echinox real estate consultancy company. Ongoing negotiations target office buildings (30% of the value above), retail projects (30%) and logistics parks (40%), with around half of the assets being located in Bucharest.

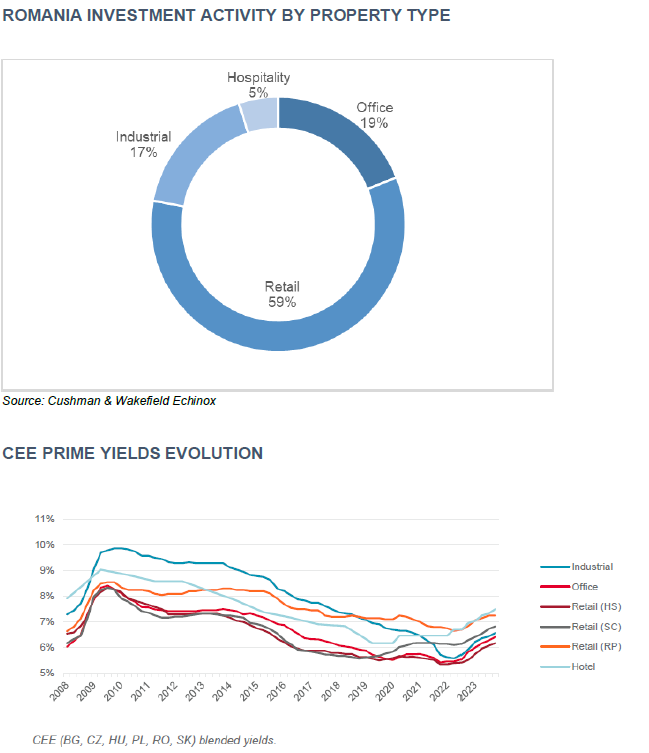

A real estate investment volume of only €488 million was recorded in Romania in 2023, corresponding to a decrease of 62% compared with 2022. The increasing financing costs and the investors’ reluctancy towards the office sector, which had been the preferred asset class during the previous 5 years, have significantly impacted the investment activity. As a result, transactions with office buildings represented only 19% of the 2023 volume, a stark difference when compared with a contribution of more than 60% in the 2018-2022 period.

Cristi Moga, Head of Capital Markets Cushman & Wakefield Echinox: “After a 5-year period (2018 – 2022) in which the investment volume related to office buildings in Romania amounted to almost €3 billion (~€600 million yearly on average), only €94 million worth of transactions were concluded in 2023, the lowest level of the last 15 years. However, if take into account the gradual return of the office utilization rates to around 70% of the pre-pandemic benchmarks, the limited pipeline and the total 2023 take-up volume of nearly 500,000 sq. m (an all – time annual market record), we expect investors to renew their interest towards this asset class.”

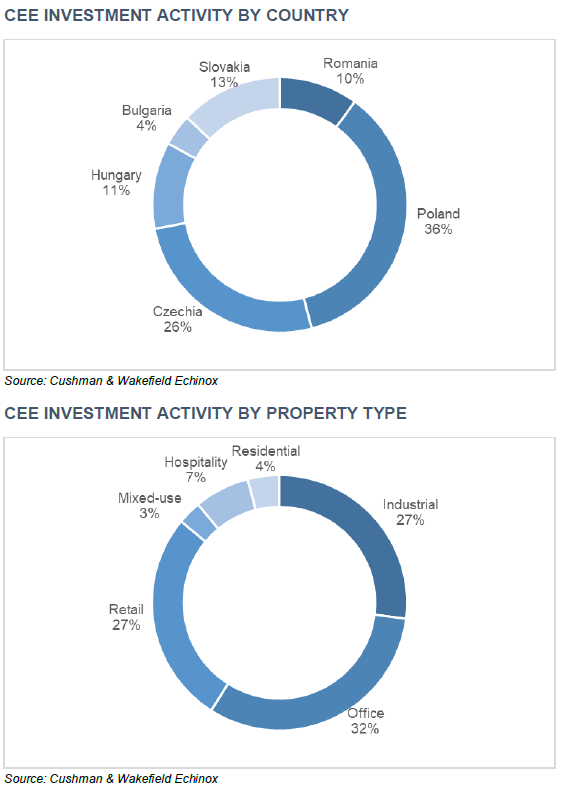

The total transactional volume at regional level reached €5.02 billion in 2023, a 55% drop compared with 2022.

All countries in the CEE – Czechia, Poland, Romania, Hungary, Bulgaria and Slovakia, reported a downward movement in 2023 (ranging between 16% and 68%), the biggest one being in Poland, which still remains the most active market in the region (with a share of 36%), followed by Czechia (26%), while Romania had a 10% share in the overall CEE volume.

Furthermore, a segment-by-segment analysis shows that the share of offices in the total volume decreased to around 20% in both Poland and Czechia, similar to the level registered on the local market.

The largest transaction concluded in 2023 was Mitiska REIM’s disposal of its retail park portfolio in Romania (133,600 sq. m GLA) to the M Core British investment group for €219 million, a landmark transaction which was a record for the retail sector in the past 10 years. Other relevant deals were related to FM Logistic’s sale and leaseback of its Romanian portfolio (98,000 sq. m GLA) to CTP for around €60 million or the disposal of One Herastrau Office for €21 million. More than 60% of the total transactional volume was connected to portfolio sales.

The prime yields have seen upward movements across all segments, due to the increasing financing costs, in line with the trends registered across Europe, as the office and retail ones each recorded 50 bp annual spikes, with a lower 25 bp rise for industrial & logistics assets.

The highly anticipated interest rate cuts in the coming months are expected to contribute to a yield stabilization throughout 2024 in Romania.

The highly anticipated interest rate cuts in the coming months are expected to contribute to a yield stabilization throughout 2024 in Romania.

Cushman & Wakefield Echinox is a leading real estate company on the local market and the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, with a team of over 80 professionals and collaborators offering a full range of services to investors, developers, owners and tenants.

Cushman & Wakefield (NYSE: CWK) is a leading global commercial real estate services firm for property owners and occupiers with approximately 52,000 employees in approximately 400 offices and 60 countries. In 2022, the firm reported revenue of $10.1 billion across its core services of property, facilities and project management, leasing, capital markets, and valuation and other services. It also receives numerous industry and business accolades for its award-winning culture and commitment to Diversity, Equity and Inclusion (DEI), Environmental, Social and Governance (ESG) and more. For additional information, visit www.cushmanwakefield.com.