Construction Insights 2026

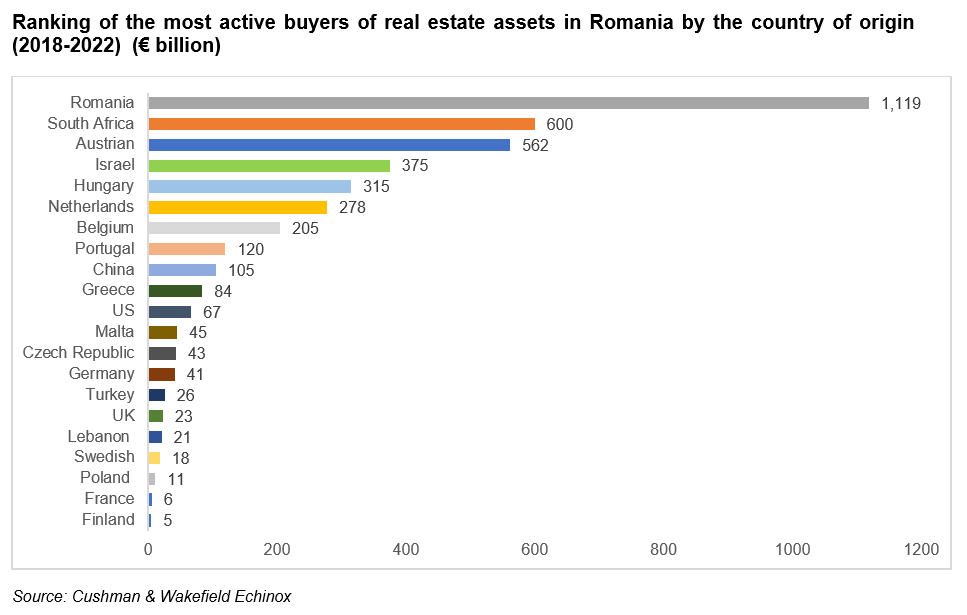

Bucharest, May 2023: The Romanian investors have made real estate acquisitions worth €1.1 billion in the last 5 years, having a share of 28% in the investment volume recorded during this interval. Therefore, they have been the most active buyers of income-producing real estate assets in Romania, according to data from the Cushman & Wakefield Echinox real estate consultancy company.

The local investors are followed by those from South Africa (with acquisitions worth €600 million, corresponding to 15% of the total volume) and Austria (14% share), two countries from which Romania has been constantly attracting real estate capital in the past 15 years. The following two positions in the ranking are filled by investors from Israel (9%) and Hungary (8%).

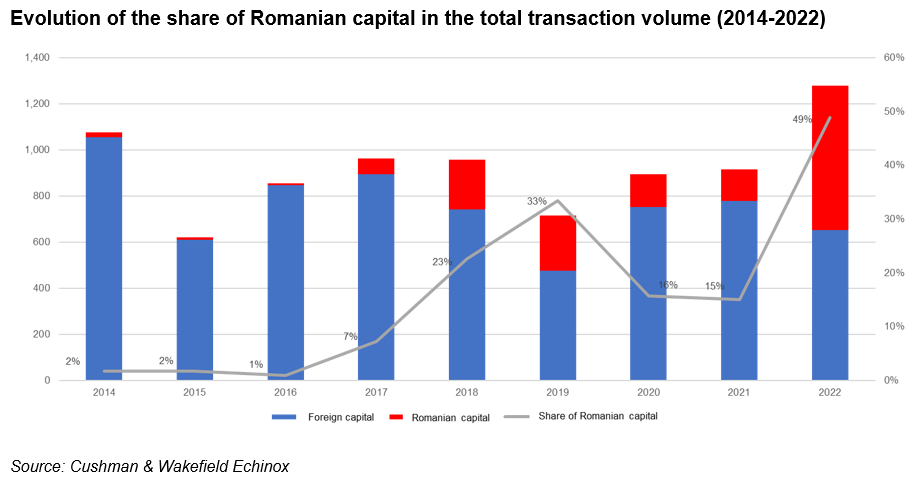

The presence of local capital on the real estate transaction market has seen a significant surge between 2018 and 2022, as in the previous 5-year period (2013 – 2017) the share of Romanian investors had only ranged between 1% and 7% in this regard.

The most active Romanian investor during the 2018 – 2022 period was the Dedeman group (Pavăl Holdings) which has speedily climbed to the 2nd position in the ranking of office owners in Romania through acquisitions worth €850 million, now having portfolio totalling around 380,000 sq. m of office spaces.

Another local investor with significant market activity was One United, which has specifically targeted small and medium-sized office buildings, some of which being disposed of in the meantime. Moreover, they have also focused on historic buildings located in the Central area of Bucharest, aiming at refurbishing and reconverting them into hotel facilities or residential spaces.

Cristi Moga, Head of Capital Markets, Cushman & Wakefield Echinox: “The presence of Romanian investors on the real estate market reflects the accumulation of capital that has been taking place in the last 10 years of steady economic growth and it provides an element of stability especially during periods of uncertainty. As far as the profile of local investors is concerned, they have a better understanding of consumer and space occupancy trends, as well as being more confident about the positive evolution of the economy on the medium and long terms. Moreover, they also have a good grasp of the cyclical nature of the real estate market in Romania.”

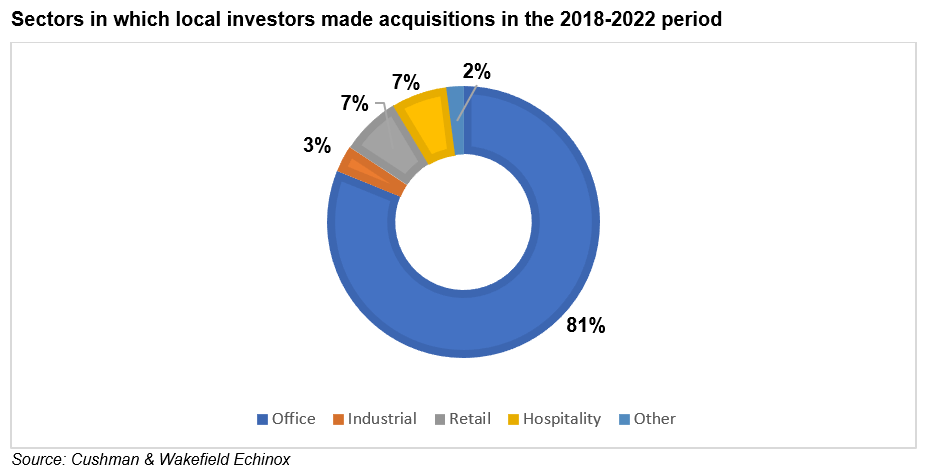

In terms of the market segments which have drawn the attention of Romanian investors in the past 5 years, office projects accounted for 81% of the total volume, with the retail and hotel sectors following suit (each having a market share of 7%).

In terms of the market segments which have drawn the attention of Romanian investors in the past 5 years, office projects accounted for 81% of the total volume, with the retail and hotel sectors following suit (each having a market share of 7%).

The dynamic of real estate transactions in the last few years has also resulted in a change pertaining to the hierarchy of the top players on the market, mainly on the office segment. NEPI Rockastle’s (a South African investment fund) disposal of its office portfolio in Romania to AFI Europe opened the way for such changes. Then came the exit of the Austrian group CA IMMO from the Romanian market, while the S Immo and Immofinanz portfolios were consolidated under the umbrella of a Czech – based fund, namely the CPI Property Group. In the wake of these transactions, Globalworth kept its position as the office market leader, being followed by Pavăl Holding, CPI Property and AFI Europe.

Moreover, the CPI Property takeover of S Immo and Immofinanz propelled the Czech group to the 1st position regarding shopping center and commercial park owners in Romania, ranking alongside NEPI Rockastle and Iulius Group (in partnership with Atterbury).

The industrial and logistics segment, although being on the investors’ radar, has not seen major changes at the top. While CTP and Globalworth increased their portfolios also via acquisitions, WDP, P3 and Logicor opted only for organic growth.

Cushman & Wakefield Echinox is a leading real estate company on the local market and the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, with a team of over 80 professionals and collaborators offering a full range of services to investors, developers, owners and tenants.

Cushman & Wakefield, one of the global leaders in commercial real estate services, with 52,000 employees in over 60 countries and $ 10.1 billion in revenue, provides asset and investment management consulting services, capital markets, leasing, properties administration, tenant representation. For more information, visit www.cushmanwakefield.com