Romania Investment Marketbeat H2 2025

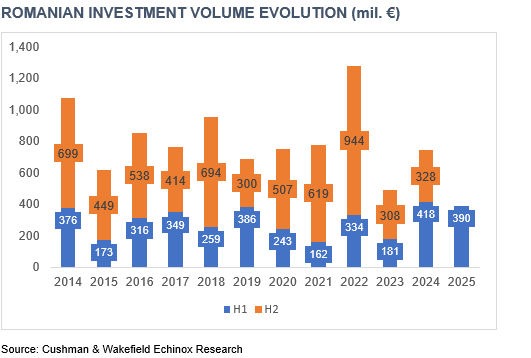

Bucharest, July 2025 – The total volume invested in income-producing real estate assets – office, retail, logistics and industrial spaces and hotels – in Romania reached approximately €391 million in the first half of 2025, corresponding to a slight decrease of 6.5% compared to the same period in 2024 (€418 million). However, the first semester of 2025 is ranked as the second best-performing H1 in the last 12 years, being 30% above the average of the first semesters of the analyzed period.

Cushman & Wakefield Echinox was involved in three of the largest transactions concluded this year, with a combined value of €160 million, representing over 40% of the total volume.

These included the sale of a portfolio of 7 strip malls in Slobozia, Focșani, Râmnicu Sărat, Sebeș, Făgăraș, Târgu Secuiesc, and Gheorgheni, the Focșani Mall and the largest part of the IRIDE Business Park in Bucharest, cosisting 17 mixed-use buildings (offices, storage, light production) on a 128,000 sqm plot near the Pipera metro station.

Cristi Moga, Head of Capital Markets at Cushman & Wakefield Echinox: “The results from the first half of the year confirm the renewed interest from foreign investors in the local real estate market, who contributed over 70% of the transaction volume. The outlook for the second half remains positive, considering ongoing transactions and the historical trend of stronger H2 activity. We expect a total investment volume between €800 million and €1 billion for the full year.”

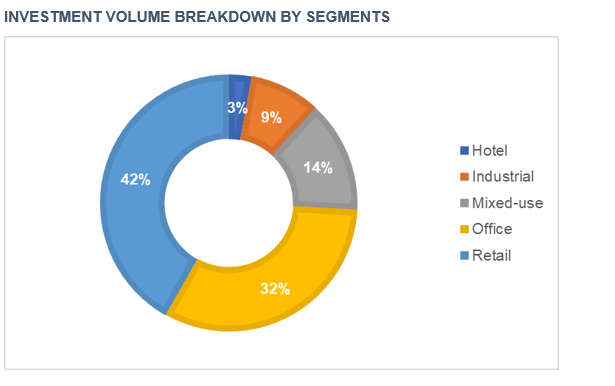

In terms of asset class, the highest volume pertained to retail segment (€163 million, 42% of total), followed by office properties (€126 million, 32%) and mixed-use projects (€55 million,14%).

The office segment showed a strong rebound, increasing its share from 5% in H1 2024 to nearly one-third of the total in H1 2025. This was driven by improved office space utilization and a slight drop in vacancy rates.

The investors from United Kingdom with transactions concluded of €148 million (38% of total), form Romania with €105 million (27%) and Hungary with €52 million (13%) were the most active in the market in the analyzed period.