Romania Industrial Marketbeat Q4 2025

Bucharest, February 2026: Demand for industrial and logistics space increased by 51% in 2025, reaching 1.275 million square meters, the second-highest level in the modern history of the local market, according to data from the real estate consultancy company Cushman & Wakefield Echinox.

Most of the leased area – 60% (774,000 sqm) – represents new demand, showing the interest of companies in expanding their logistics and industrial facilities despite local and global macroeconomic fluctuations and uncertainties, as well as an overall consolidation of the market.

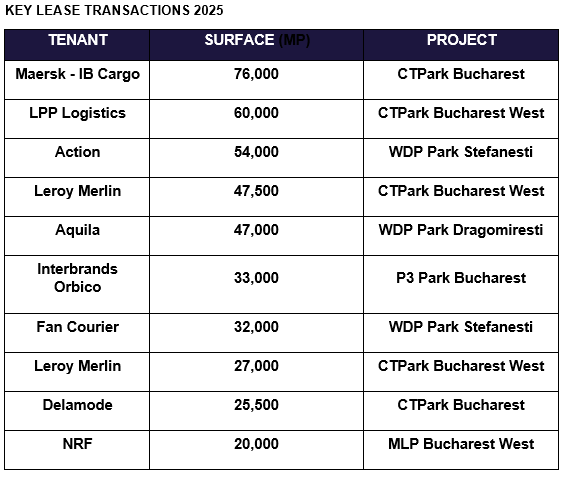

Demand was strongly polarized around Bucharest, which remained the preferred destination for tenants and accounted for 75% of the total leased area in 2025. Timisoara (77,100 sqm), the second-largest logistics hub in the country, ranked second. Retail, e‑commerce, and FMCG companies were the most active, contracting 430,000 sqm, followed by logistics operators with 217,000 sqm, and FMCG and courier companies with 80,000 sqm.

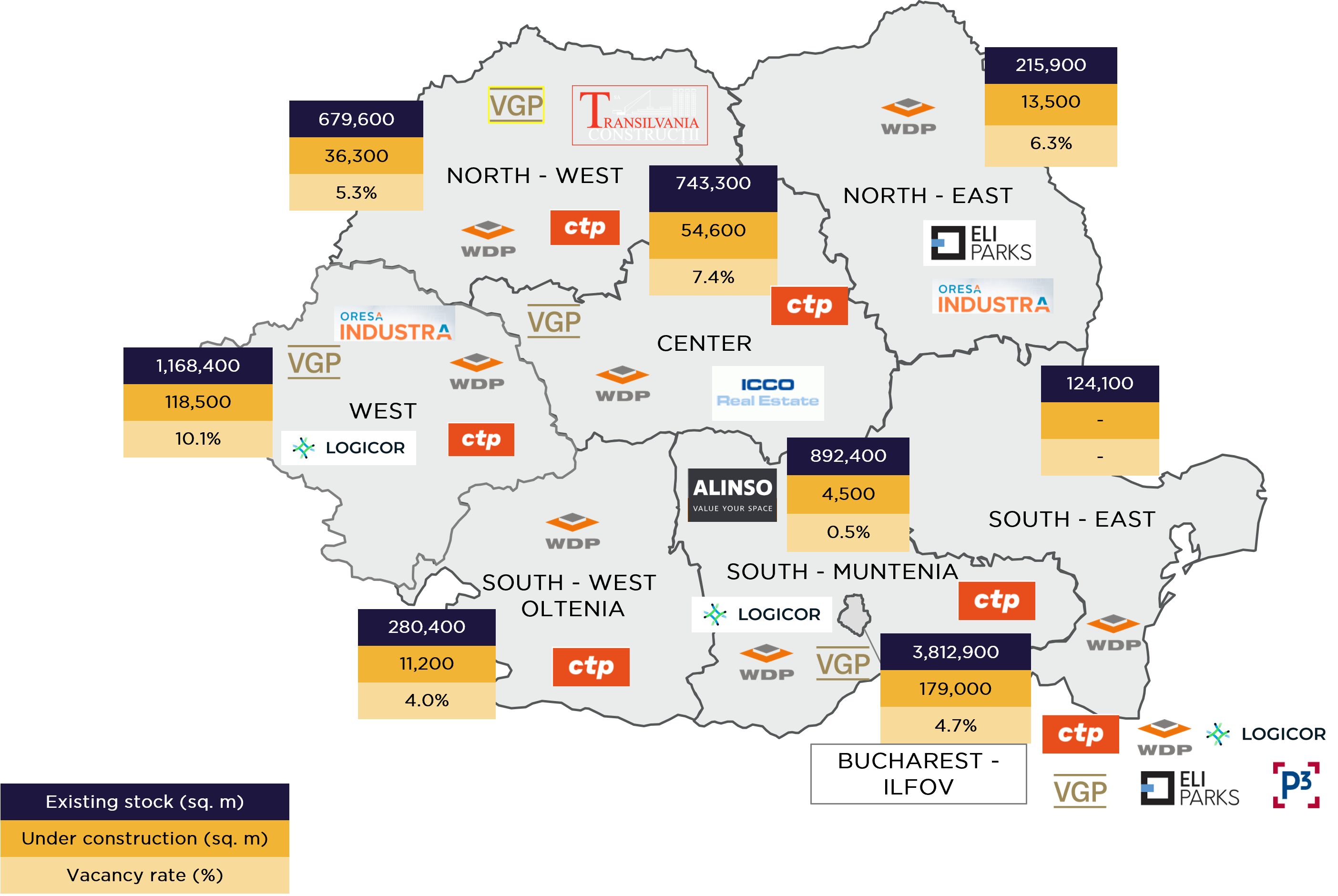

The sustained growth in demand led to a slight decrease in the nationwide vacancy to 5.3%, with 4.7% in Bucharest. Thus, 417,000 sqm of industrial and logistics spaces remain vacant nationwide, of which 180,000 sqm are located around Bucharest.

The industrial and logistics stock is expected to reach approximately 8.3 million sq m by the end of this year, with nearly half of the total area concentrated in the Bucharest-Ilfov region, which will also benefit from more than 70% of the new deliveries announced for this year.

For 2026, developers have announced the delivery of around 350,000 sqm of new logistics and industrial parks, a similar level to 2025. The largest volume will be built in Bucharest-Ilfov (260,000 sqm), the Centre region (49,000 sqm), and the North‑East (20,000 sqm).

In 2025, new projects totaling 332,000 sqm were delivered, marking a 42% decrease compared to 2024, a contraction driven primarily by the slowdown in speculative development.

As a result, the industrial and logistics stock reached 7.9 million sqm at the end of last year, with 48% located in Bucharest, 15% in the West region (Timișoara, Arad, Deva, Caransebeș), 12% in South‑Muntenia (Pitești, Ploiești), 9.4% in the Centre region (Brașov, Sibiu, Târgu Mureș, Alba Iulia) and 8.6% in the North‑West (Cluj, Oradea, Baia Mare).

In Moldova, although the regional stock increased by 29% over the past three years – the second‑strongest growth among the eight regions, supported by transport infrastructure development – it remains one of the least developed markets nationwide, with only 2.7% of Romania’s total industrial and logistics stock.

Romania is the third‑largest industrial and logistics market in Central and Eastern Europe, after Poland – the regional leader with 36.4 million sqm – and the Czech Republic, with 13,2 million sqm.

Ștefan Surcel, Head of Industrial Agency, Cushman & Wakefield Echinox: “The evolution of recent years confirms the maturity of the local logistics and industrial market, one of the most dynamic in the region. Infrastructure projects such as A0 and A8 are reshaping logistics flows and creating new regional hubs, with the most significant examples being Stefanești, the northern of Bucharest, and the cities of Iasi and Bacau in Moldova. At the same time, we see an increasing number of consolidation processes, through which companies seek to optimize supply chains, reduce costs, and accelerate delivery timelines. The balance between new demand and renegotiations reflects a mature market behavior in which logistics, distribution, retail, and e‑commerce operators continue to be the main drivers of activity. What also emerges from discussions with potential investors is that Romania is no longer perceived as a cheap and competitive market for labor‑intensive, low‑skilled production activities. Instead, it is seen as a market capable of supporting production facilities for more sophisticated, high value‑added goods – a shift that is repositioning the local market within regional production chains and boosting demand for modern, well‑connected, and sustainable industrial spaces.”

Ștefan Surcel, Head of Industrial Agency, Cushman & Wakefield Echinox: “The evolution of recent years confirms the maturity of the local logistics and industrial market, one of the most dynamic in the region. Infrastructure projects such as A0 and A8 are reshaping logistics flows and creating new regional hubs, with the most significant examples being Stefanești, the northern of Bucharest, and the cities of Iasi and Bacau in Moldova. At the same time, we see an increasing number of consolidation processes, through which companies seek to optimize supply chains, reduce costs, and accelerate delivery timelines. The balance between new demand and renegotiations reflects a mature market behavior in which logistics, distribution, retail, and e‑commerce operators continue to be the main drivers of activity. What also emerges from discussions with potential investors is that Romania is no longer perceived as a cheap and competitive market for labor‑intensive, low‑skilled production activities. Instead, it is seen as a market capable of supporting production facilities for more sophisticated, high value‑added goods – a shift that is repositioning the local market within regional production chains and boosting demand for modern, well‑connected, and sustainable industrial spaces.”

The prime headline rents in Bucharest and in the main industrial & logistics hubs across the country remained flat, generally ranging between €4.30 – 4.75/ sq. m/ month in Bucharest, Cluj – Napoca, Timisoara, Brasov, Ploiesti, Pitesti or Sibiu. These levels could see minor upward adjustments in the coming quarters, in a context where both construction costs and land acquisition prices are constantly increasing in all relevant locations in Romania.

Romania offers the most competitive occupancy costs in Central and Eastern Europe for companies seeking to lease industrial and logistics space. Countries with which Romania often competes for investments offer rents up to 60% higher – for example, the Czech Republic.

Prime rents in Hungary are of €5.7/sqm/month, in Czech Republic of €7.5/sqm/month and in Poland of €5.75/sqm/month.