Food Halls of Europe 2024/25 Edition

Bucharest, November 2023: The average office transaction size during the first 9 months of 2023 has been of 1,810 sq. m, the highest average registered in the last 4 years and close to the record level of 1,900 sq. m set in 2019, according to data from the Cushman & Wakefield Echinox real estate consultancy company.

Compared with 2022 and 2021, the first 9 months of this year marked a 35% increase of the average transaction size, an evolution reflected in the total demand (347,200 sq. m), corresponding to a 56% y-o-y increase. Moreover, Q3 2023 set an all – time quarterly record in terms of demand in Bucharest, with 157,100 sq. m being transacted.

Additionally, if this high level is also sustained in the coming months, the 400,000 sq. m yearly threshold is expected to be broken by the end of 2023 for the first time ever in Bucharest. However, the net take – up had a share of only 35% in the total leased volume in Q3, while the vacancy rate saw a decrease to 14.9% from 15.2% at the beginning of the year.

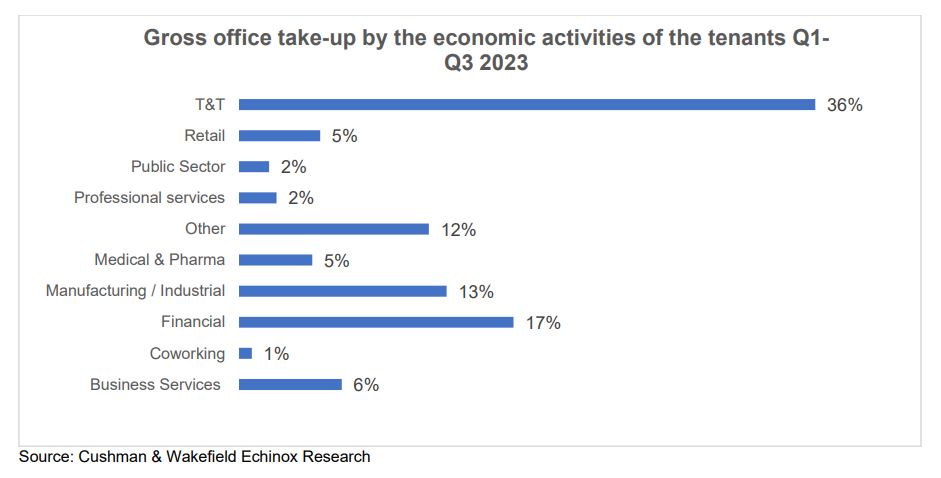

Madalina Cojocaru, Partner Office Agency Cushman & Wakefield Echinox: ”The office market in Bucharest is going through a dynamic period, as we notice the development of new trends related to the overall demand. As such, there has been a diversification in terms of the fields of activity pertaining to the companies leasing office spaces, as the IT&C sector, which usually accounts for around 40% – 50% of the total annual take-up, has started losing some of its market share, while the demand from production companies, professional and financial services companies, operators of private clinics and hospitals and even from private educational units has increased in the last few quarters. It must also be noted that, although most of the demand resulted from the renewal / renegotiation of existing spaces, companies have generally decided to maintain their contractually leased areas, with a few of them even expanding their office spaces. There has been a series of tenants which adjusted their needs for office spaces and downsized their contracted areas following renegotiations, a phenomenon which will probably continue in the coming months and which may gradually stabilize from H2 2024 onwards”.

Madalina Cojocaru, Partner Office Agency Cushman & Wakefield Echinox: ”The office market in Bucharest is going through a dynamic period, as we notice the development of new trends related to the overall demand. As such, there has been a diversification in terms of the fields of activity pertaining to the companies leasing office spaces, as the IT&C sector, which usually accounts for around 40% – 50% of the total annual take-up, has started losing some of its market share, while the demand from production companies, professional and financial services companies, operators of private clinics and hospitals and even from private educational units has increased in the last few quarters. It must also be noted that, although most of the demand resulted from the renewal / renegotiation of existing spaces, companies have generally decided to maintain their contractually leased areas, with a few of them even expanding their office spaces. There has been a series of tenants which adjusted their needs for office spaces and downsized their contracted areas following renegotiations, a phenomenon which will probably continue in the coming months and which may gradually stabilize from H2 2024 onwards”.

The Q3 new supply consisted of the 2nd building of the U – Center office project (32,500 sq. m GLA) developed by Forte Partners in the Center submarket, with the 2023 YTD new deliveries totaling 102,500 sq. m, as the office stock in the city reached 3.41 million sq. m.

Office rents in Bucharest stabilized in Q3, with no further relevant movements across the main submarkets, as the prime headline rent in the CBD area remained at €22.00/ sq. m/ month.

The under-construction pipeline in the city is fairly limited at only 80,000 sq. m GLA, the lowest it has been in the past 16 years, as a result of the still ongoing urbanistic issues related to the Bucharest municipality for which there is no resolution timeline in sight. Therefore, it is difficult to provide any forecast regarding the office supply post 2024/2025 without a clear solution pertaining to the abovementioned issues, while projects totaling more than 300,000 sq. m are waiting to receive their zoning/building permits across Bucharest.

The Cushman & Wakefield Echinox office agency has advised leasing transactions totalling more than 165,000 sq. m in Romania during the last 3 years.

Cushman & Wakefield Echinox is a leading real estate company on the local market and the exclusive affiliate of Cushman & Wakefield in Romania, owned and operated independently, with a team of over 80 professionals and collaborators offering a full range of services to investors, developers, owners and tenants.

Cushman & Wakefield, one of the global leaders in commercial real estate services, with 52,000 employees in over 60 countries and $ 10.1 billion in revenue, provides asset and investment management consulting services, capital markets, leasing, properties administration, tenant representation. For more information, visit www.cushmanwakefield.com